Registrations Closed

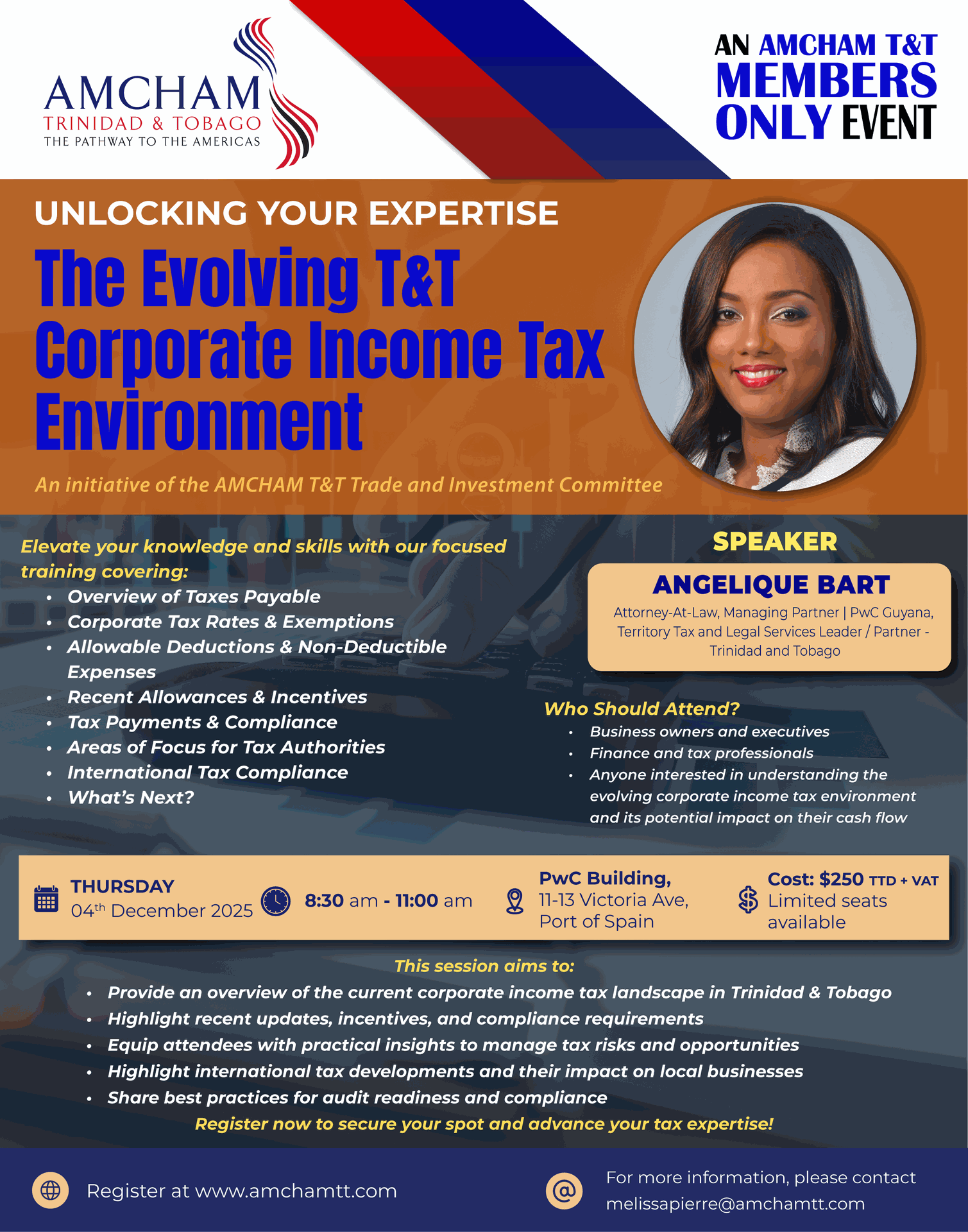

The Evolving T&T Corporate Income Tax Environment

Topics to Be Covered:

- Overview of Taxes Payable

- Corporate Tax Rates & Exemptions

- Allowable Deductions & Non-Deductible Expenses

- Recent Allowances & Incentives

- Tax Payments & Compliance

- Areas of Focus for Tax Authorities

- International Tax Compliance

- What’s Next?

Who Should Attend?

- Business owners and executives

- Finance and tax professionals

- Anyone interested in understanding the evolving corporate income tax environment and its potential impact on their cash flow

What the Session Aims to Do

- Provide an overview of the current corporate income tax landscape in Trinidad & Tobago

- Highlight recent updates, incentives, and compliance requirements

- Equip attendees with practical insights to manage tax risks and opportunities

- Highlight international tax developments and their impact on local businesses

- Share best practices for audit readiness and compliance