The ESG Landscape of Trinidad and Tobago

LINKAGE Q2 (2023) - CATAPULT

1. Introduction

AMCHAM T&T, in collaboration with the UN and the University of Delaware, undertook a survey to understand where the T&T private sector was on its ESG journey.

The prevalence of Environment, Social and Governance (ESG) issues are growing as major investors, employees and customers are signalling to companies that they are interested in companies that value not only profit but also people and planet. ESG is a business philosophy that recognises that a business’s viability, potential for success and attractiveness to investors and creditors are determined not just by the company’s finances, but also by its performance on environment, social and governance issues. Companies’ ESG performance is increasingly regulated at home and in key markets, and is subject to greater scrutiny from customers, potential business partners and those who grant licenses to operate and access to marketplaces. AMCHAM T&T took the bold step to survey its membership, which represents the wider private sector, and the results reflect the position of the Trinidad and Tobago private sector.

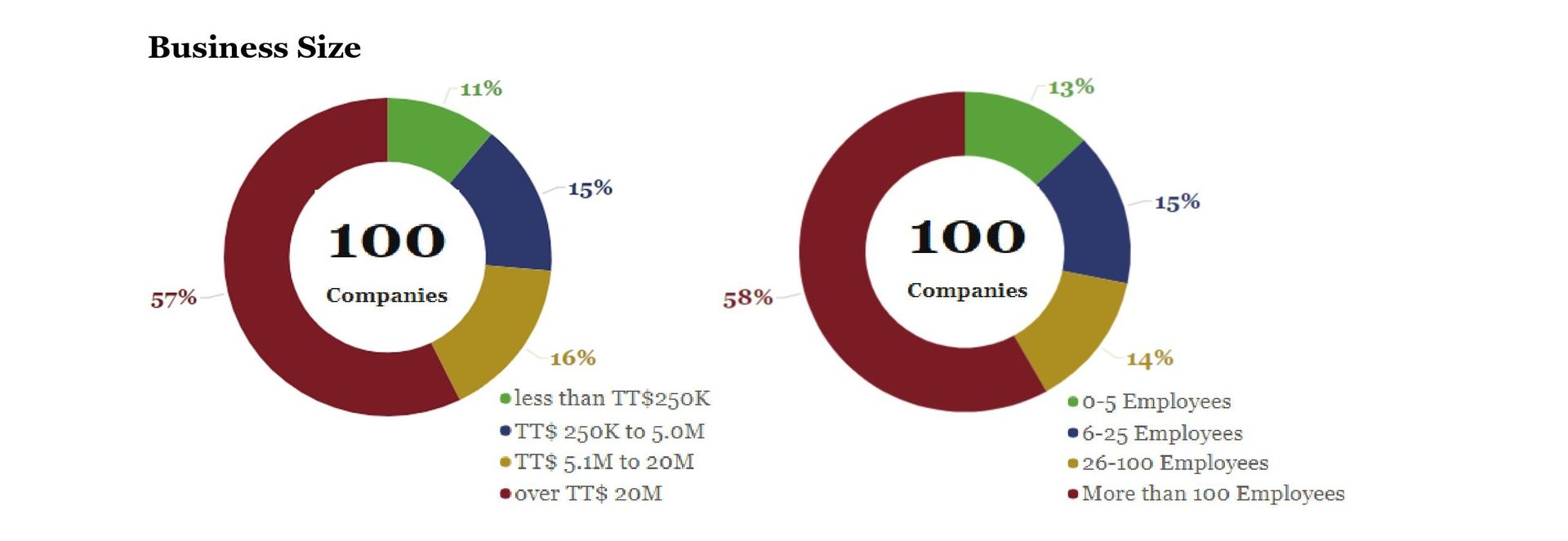

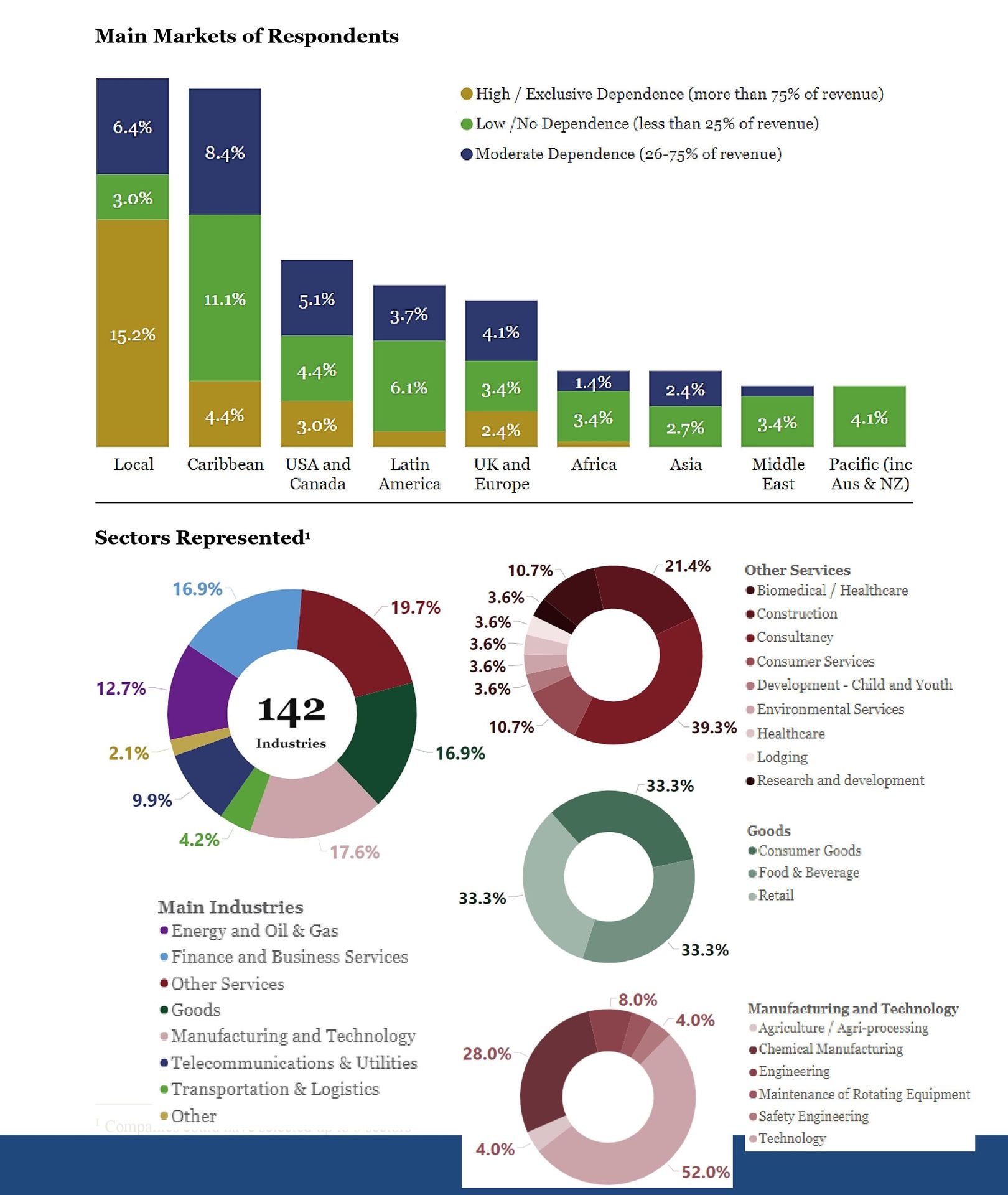

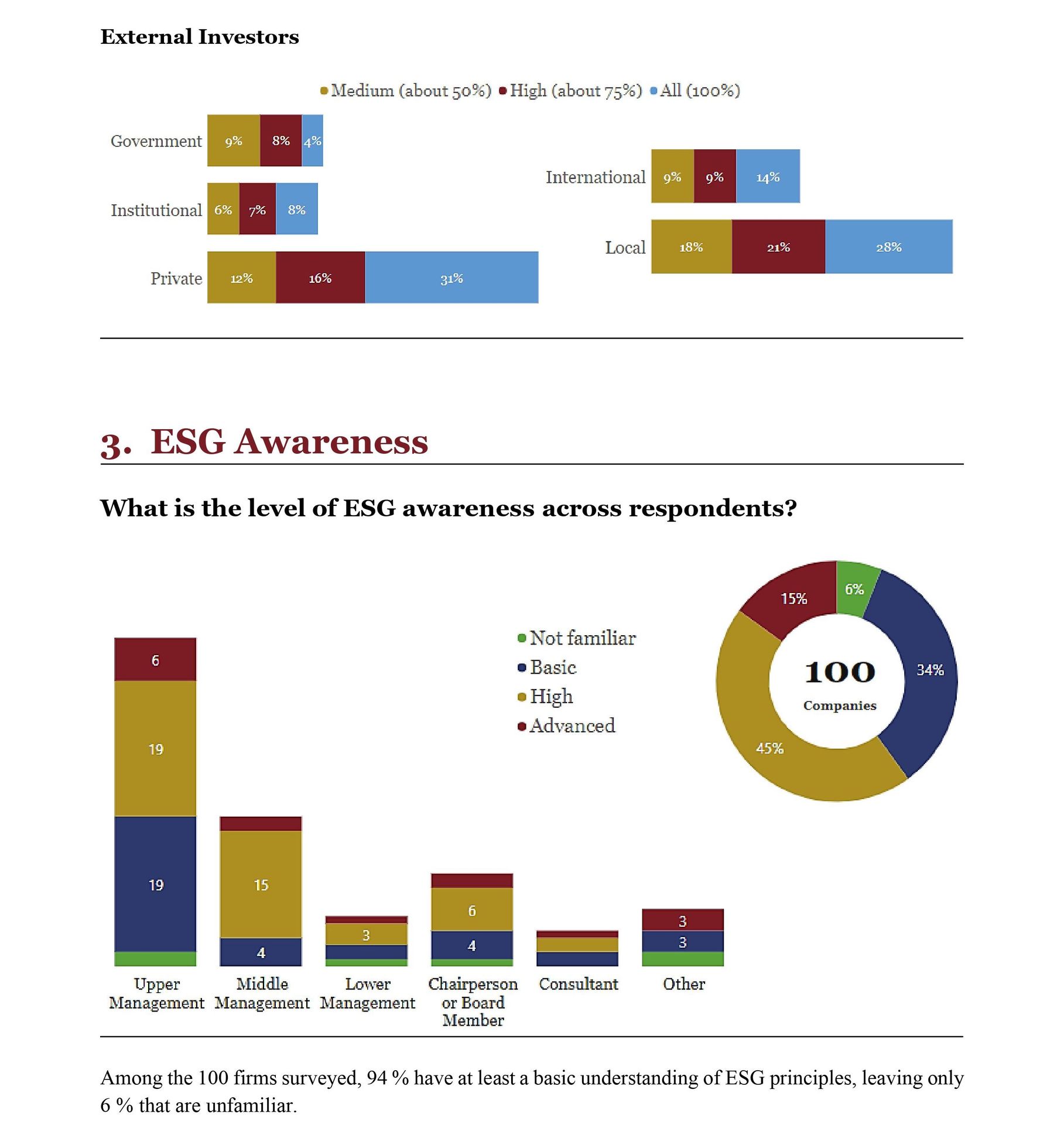

A 16-question survey was sent to the AMCHAM T&T membership and 100 companies responded, which reflected a 36% response rate. Further, one-on-one focus sessions were conducted with selected companies. The survey targetted active company leaders and senior managers to assess the existing ESG landscape in Trinidad and Tobago, and the scope for greater adoption of ESG by the local private sector. The results of the survey will be used to draft an ESG strategy for the country’s business sector.

2. Respondent Profile

3. ESG Awareness

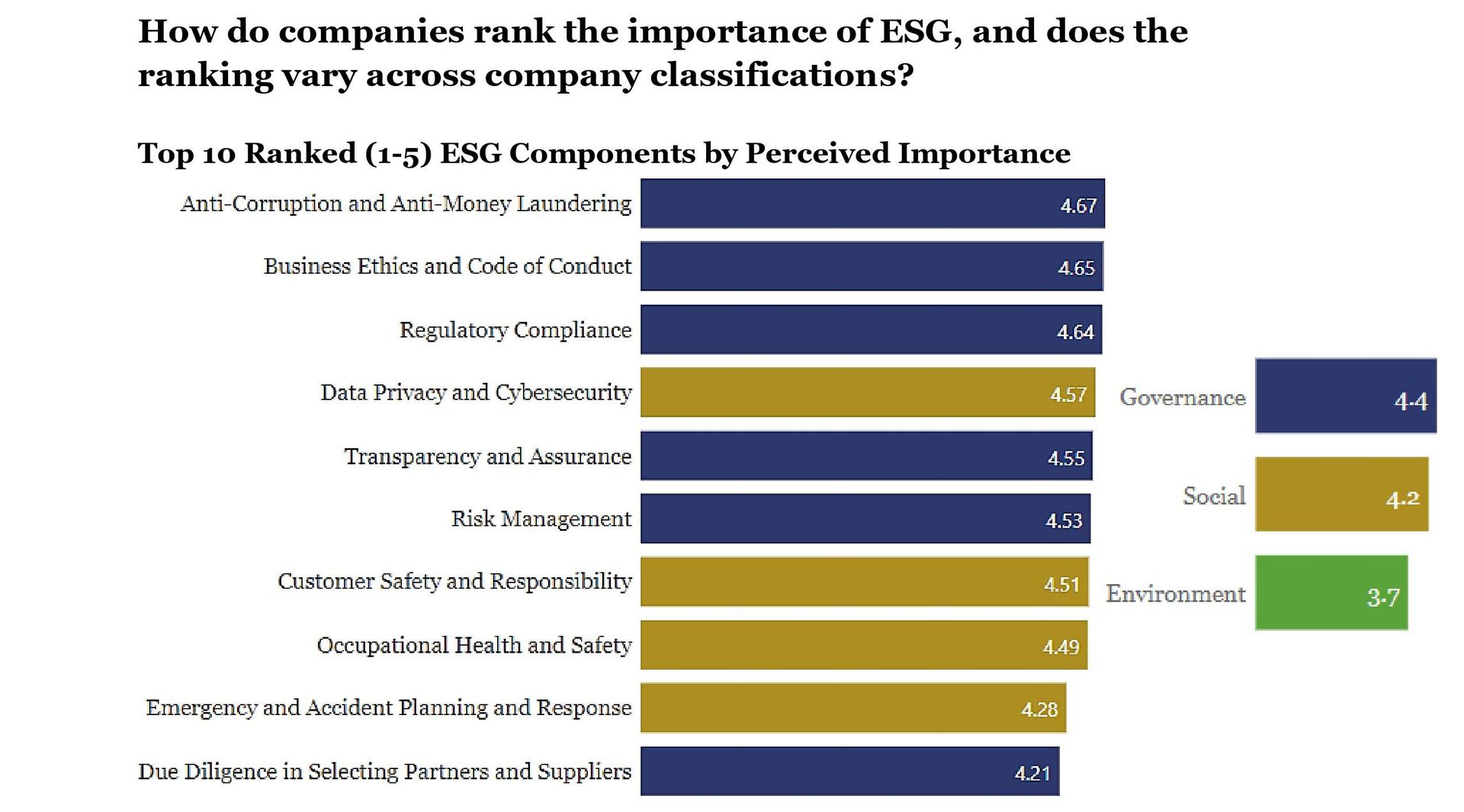

4. ESG Importance

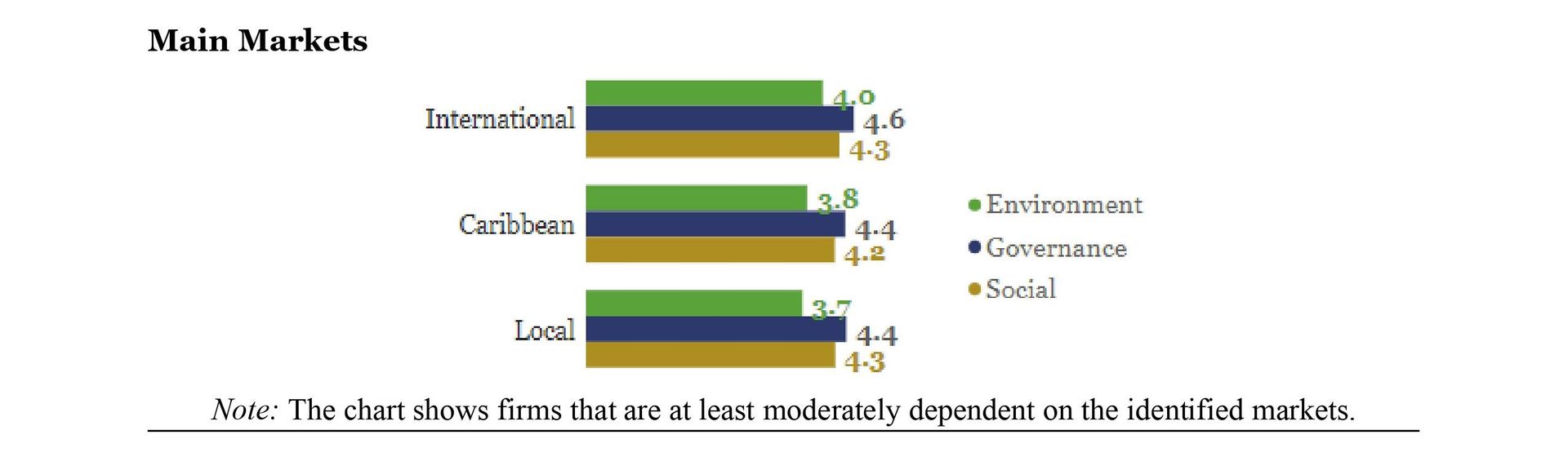

Having a list of 22 ESG components ranked by importance, the respondents were asked to express the level of importance each component holds in their firm. Governance factors had the greatest importance on average among respondents. Governance had a rank of 4.4, while social and environmental factors were ranked at 4.2 and 3.7 respectively. On average, environmental factors had the lowest ranking, with the first environmental component coming in at number 13. Firms highlighted matters of anti-corruption and anti-money laundering, business ethics and code of conduct, and regulatory compliance as being of the greatest importance. The social factors ranked with the greatest importance were data rivacy and cybersecurity, customer safety and responsibility, occupational health and safety, and emergency and accident planning response. Hence, the factors most important to respondents surrounded those that preserve the relationship of the firms with their customers, employees and regulatory bodies. They address matters that keep key stakeholders satisfied, preserve long-term profits and reduce the risk of business loss. An analysis of this result by company size and sector shows that this result is consistent.

Firms that are at least moderately dependent on international markets rate environmental and governance factors more important than those dependent on Caribbean and local markets, albeit marginally. Firms across the three categories rate the importance of social factors similarly on average. However, firms that are at least moderately dependent on local markets had the lowest rating of environmental factors of 3.7.

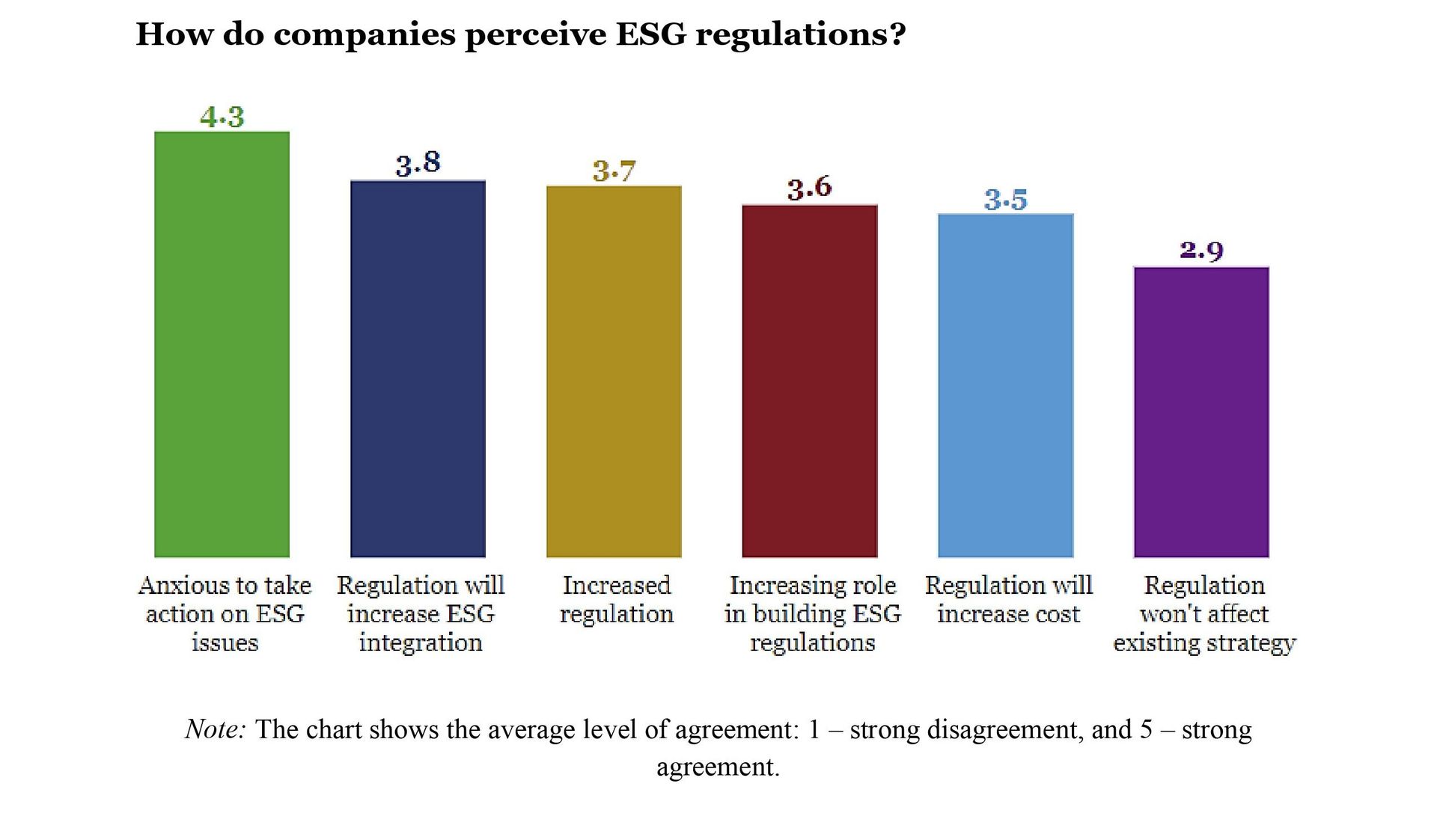

5. Perceptions of ESG Regulation

Firms were asked about the degree to which they agree with statements that address the concepts listed in the chart above. The respondents highlighted an average score of 4.3 for their level of agreement that they cannot wait on government to take action on ESG issues. They expect though that when government regulations are realised it would stimulate further ESG integration. Additionally, firms expect that there would be additional legislation within the next five years. An analysis by sector reveals that there is very little variation in response to firms being anxious for government involvement in climate action, however, firms in the finance and business services, and ‘other’ firms express strong agreement on average.

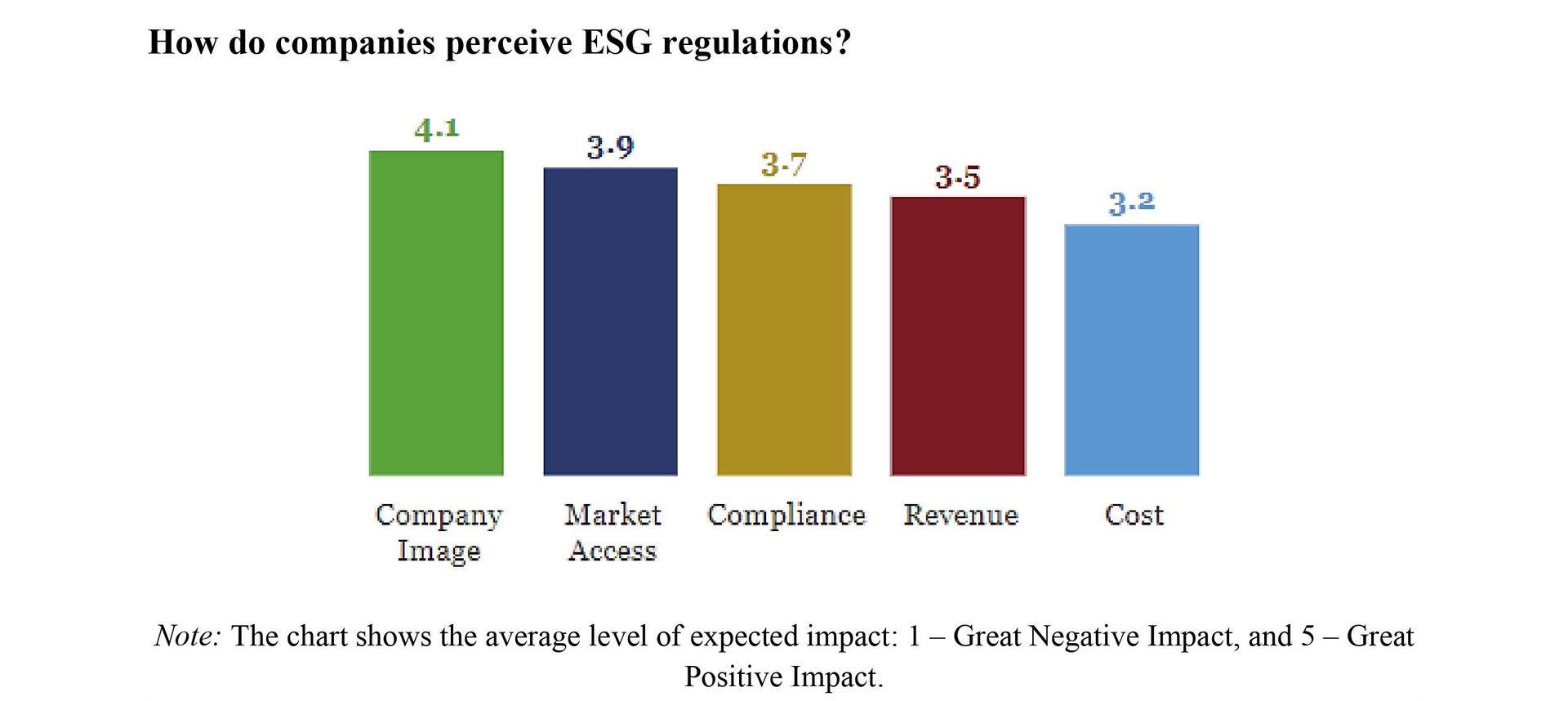

6. Expected Impact of ESG

Respondents were asked whether an ESG strategy would positively or negatively impact certain aspects of their business in the next five years. On average, firms believe that ESG will have a moderately positive impact on the company’s image. Likewise, the average responses show that firms expect a moderately positive impact of ESG on the firm’s ability access to markets. Firms were also asked about the expected impact of ESG on the ease of reporting and disclosing business performance as represented by the impact on ESG compliance. The average response among firms was that an ESG strategy would have a moderately positive impact on the ease of reporting. Regarding the firm’s expected profitability, the average firm expects a moderately positive impact of ESG on the firm’s revenue, but no impact on cost.

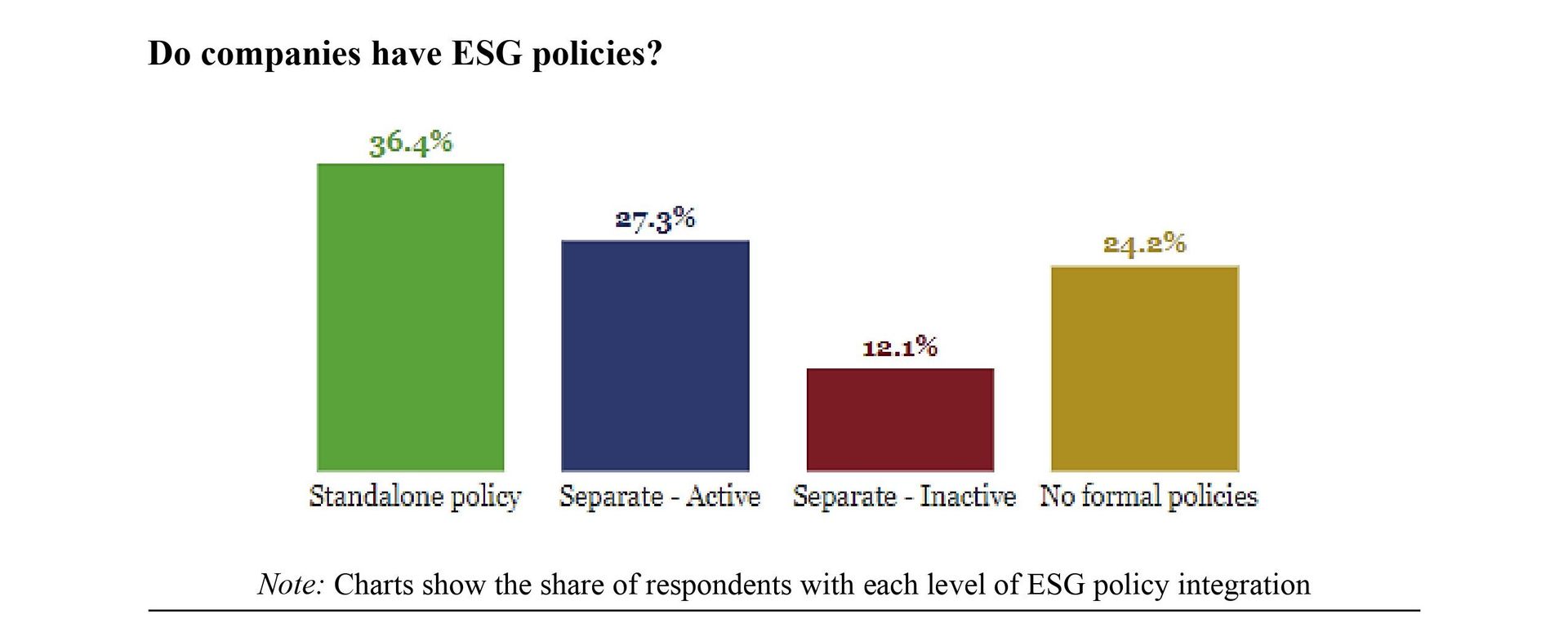

7. ESG Integration

Firms were asked what best describes the current extent of ESG integration. 36.4 % of the respondents highlighted that there is a coordinated centrally standalone ESG policy, with the associated capabilities, procedures and systems well established and consistently applied, embedded throughout the organisation, and regularly reviewed and improved. 27.3 % have a separate ESG policy that is not centrally coordinated but actively applied within departments. 12.1 % have separate ESG policies that are not consistently applied and not regularly reviewed, while 24.2 % have no formal ESG policies.

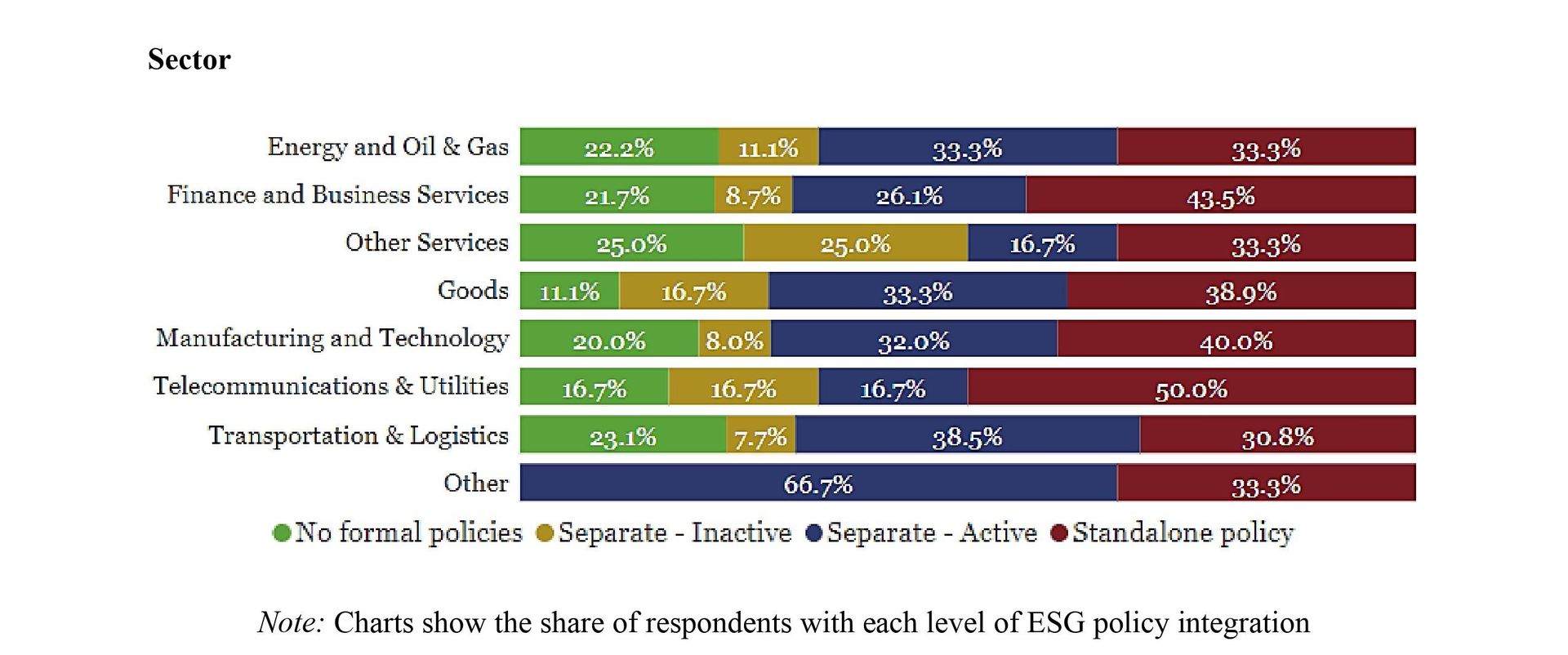

At least 50% of the firms in each sector have either a standalone ESG policy or separate but active policies. The goods sector has the largest share of firms with an active ESG policy, and only 11.1 % of firms with no formal ESG policy. The other services sector has the least share of firms with an active ESG policy, and the highest share of firms with no ESG policy. Telecommunications and utilities have the largest share of firms with a standalone ESG policy, followed by the finance and business services sector.

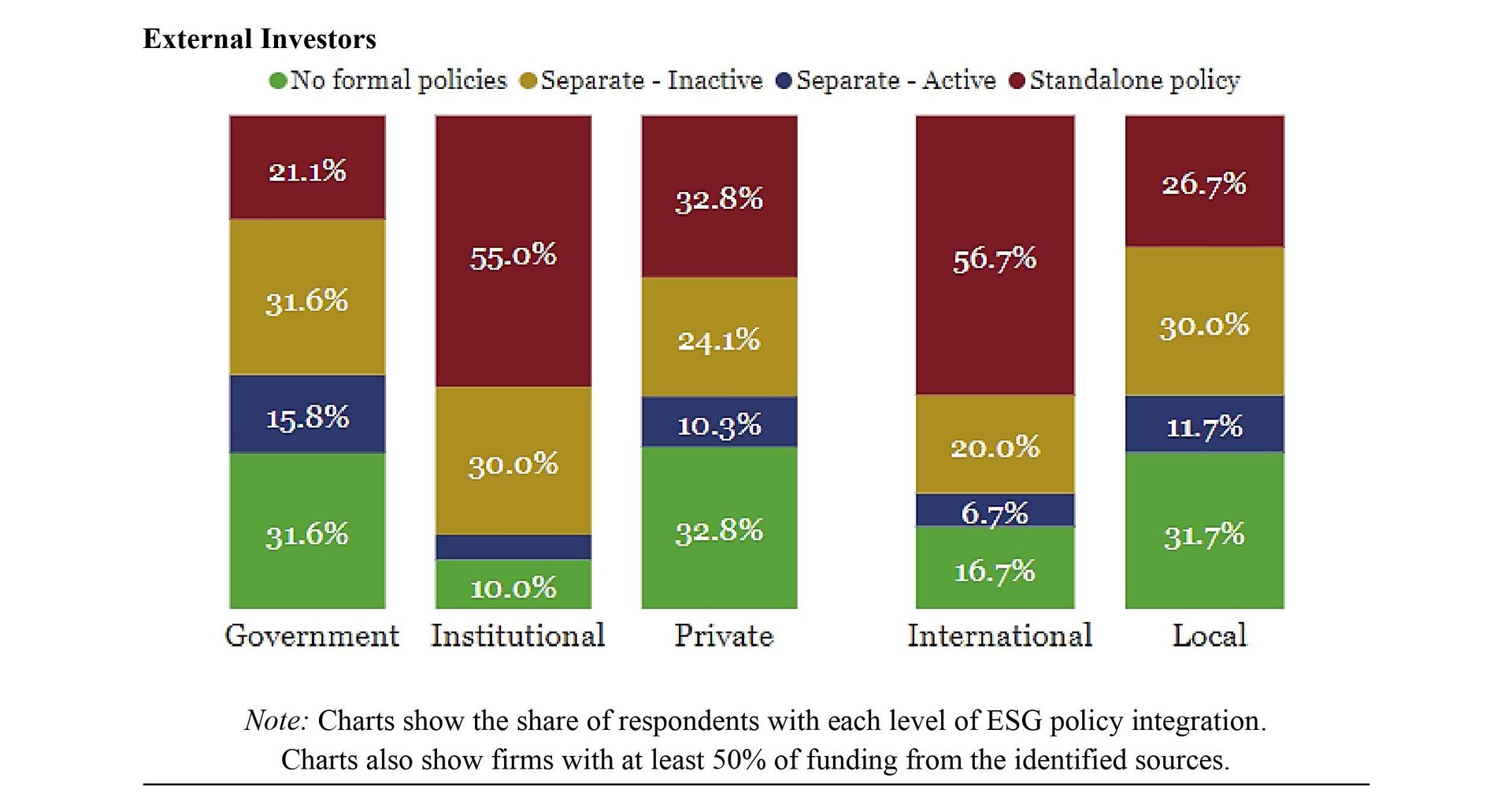

Firms dependent on institutional funding have the largest share of firms with a standalone ESG policy. Those dependent on government funding have the largest share of firms with either no formal ESG policies or separate and inactive ones. Privately funded firms have an equal share of firms with standalone policies and no formal policies. On the other hand, firms dependent on international funding have 63.4 % of their firms with either separate active policies or a standalone ESG policy. Only 16.7 % of these firms have no formal policies. Firms dependent on local funding have 61.7 % of their firms with either no formal policies or inactive ones. It may be that the institutional investors and international investors are requiring firms to have ESG policies which they are developing as stand alone, that have to still be fully integrated into their overall strategies.

8. Reasons for Slow Integration

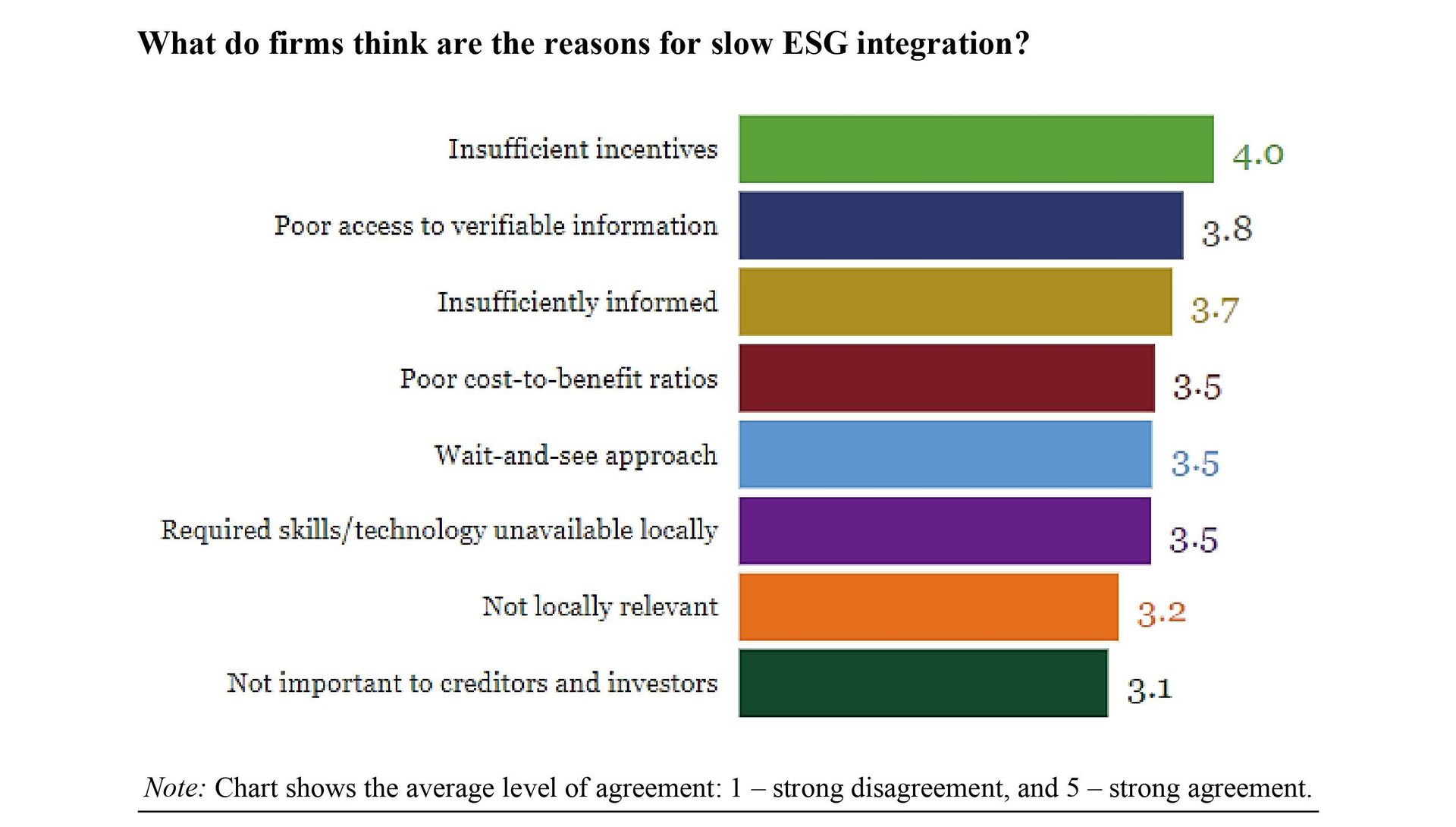

The respondents were asked about the reasons companies may be slow to integrate ESG policies. The average response of all firms suggests that they somewhat agree that there are insufficient incentives from government and others to encourage companies to adopt ESG policies. They also somewhat agree that there are difficulties in accessing verifiable information on the ESG performance throughout the business’s supply chain as well as insufficient information for the development of company ESG strategies. With a shared score of 3.5, firms somewhat agree that the skills required for ESG integration are not locally available and that the adoption of ESG strategies has poor cost-to-benefit ratios. The average response of all firms is also that they somewhat agree that ESG standards and regulations are constantly evolving and prefer to wait and see rather than to act now. Lastly, the respondents neither agree nor disagree with ESG having little relevance to the local context or unimportance to major stakeholders.

9. Current Business Practices

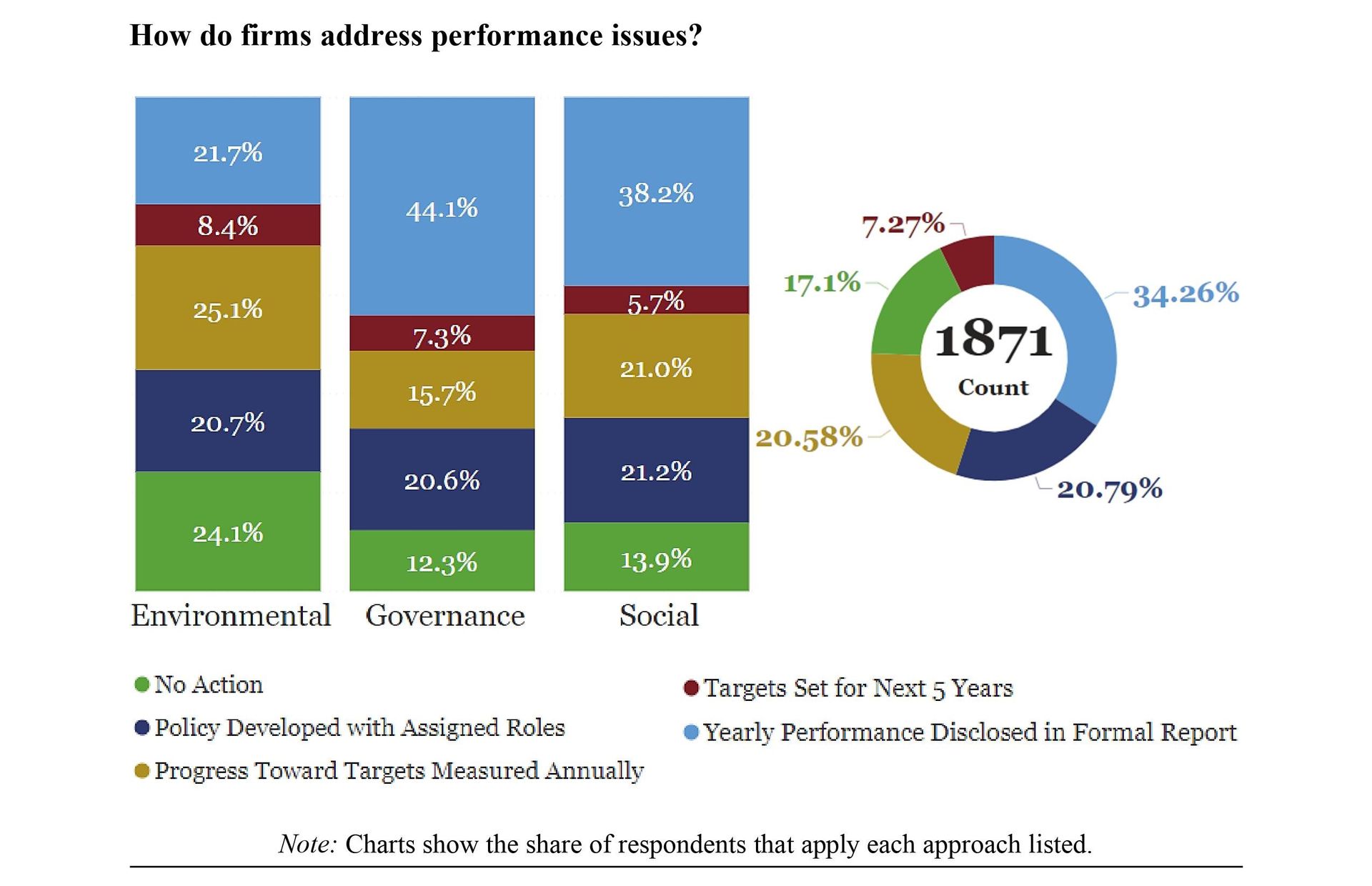

The firms were asked about their method of problem-solving various ESG-related issues. Performance disclosures in annual reports are the most used method of addressing performance issues, followed by the development of policies with assigned roles. Long-term 5-year targets are the least used method of addressing performance issues. The greatest share of issues met with no action is environmental issues, which equalled 24.1%. 20.7% of the responses accounted for environmental issues addressed with policies and assigned roles. Environmental issues are mostly addressed with annually measured targets. The third most used method for addressing environmental issues is the formal annual report. Alternatively, governance and social issues are mostly addressed using formal annual reports. Policies with assigned roles constitute the second most used method of problem-solving methods for governance and social issues. 12.3% and 13.9% of the governance and social issues result in no action.

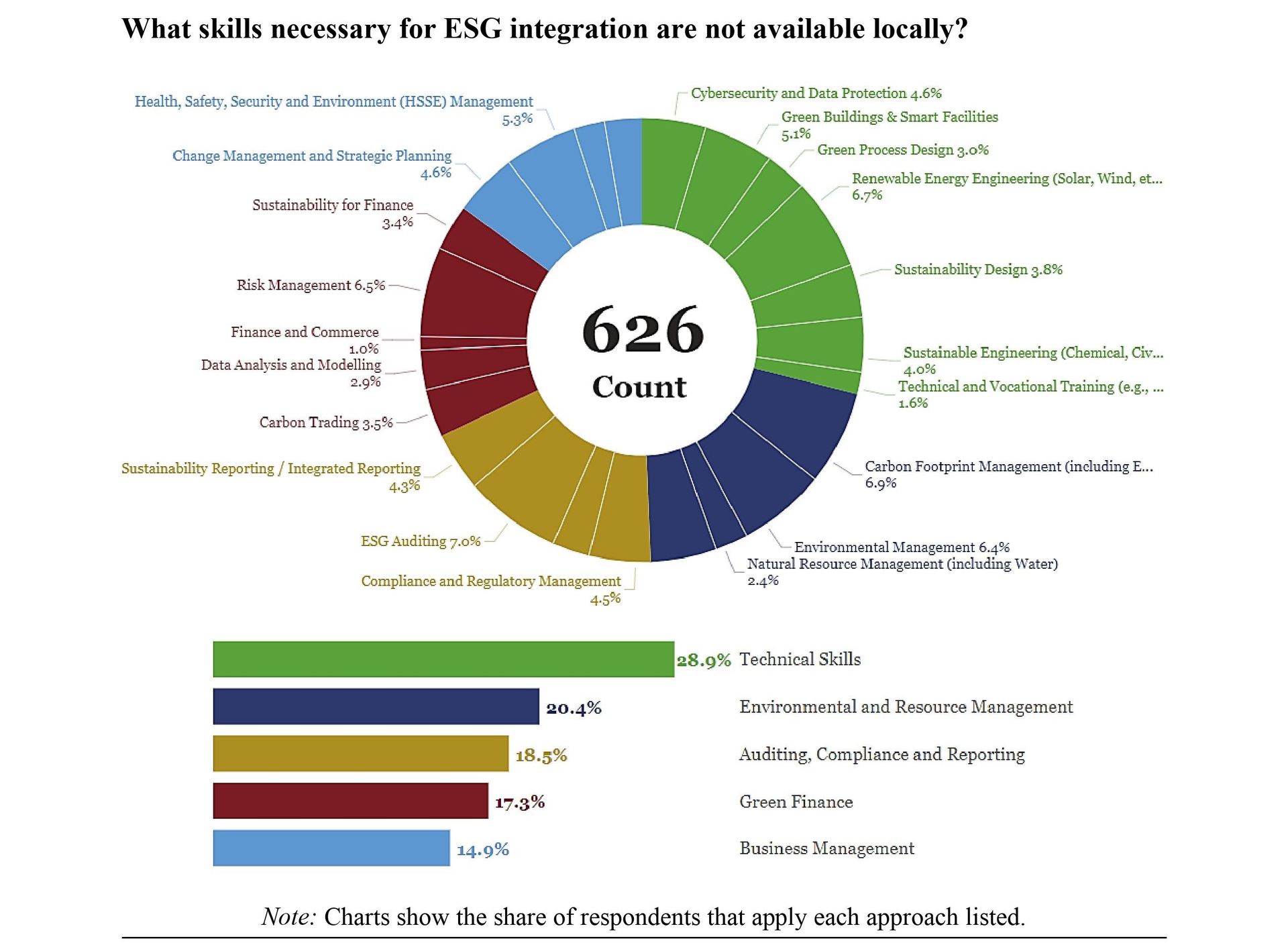

10. ESG Skills Gap

The firms were asked what necessary skills for ESG integration were not locally available. Technical skills and environmental and resource management account for almost 50% of the skills needed for ESG integration. There is considerable variation in the skills needed across sectors. The most necessary but unavailable skills identified by the energy sector were carbon footprint management, esg auditing, renewable energy engineering, and sustainable engineering. Those identified by the financial and business services sector were ESG auditing, risk management and sustainability for finance. The other services sector highlighted environmental management, risk management, and carbon trading skills. Renewable energy engineering, environmental management, and waste and pollution management accounted for the skills gap in the goods sector. The manufacturing and technology sector identified risk management, carbon footprint management, cybersecurity and data protection, environmental management and ESG auditing as necessary that are unavailable locally.

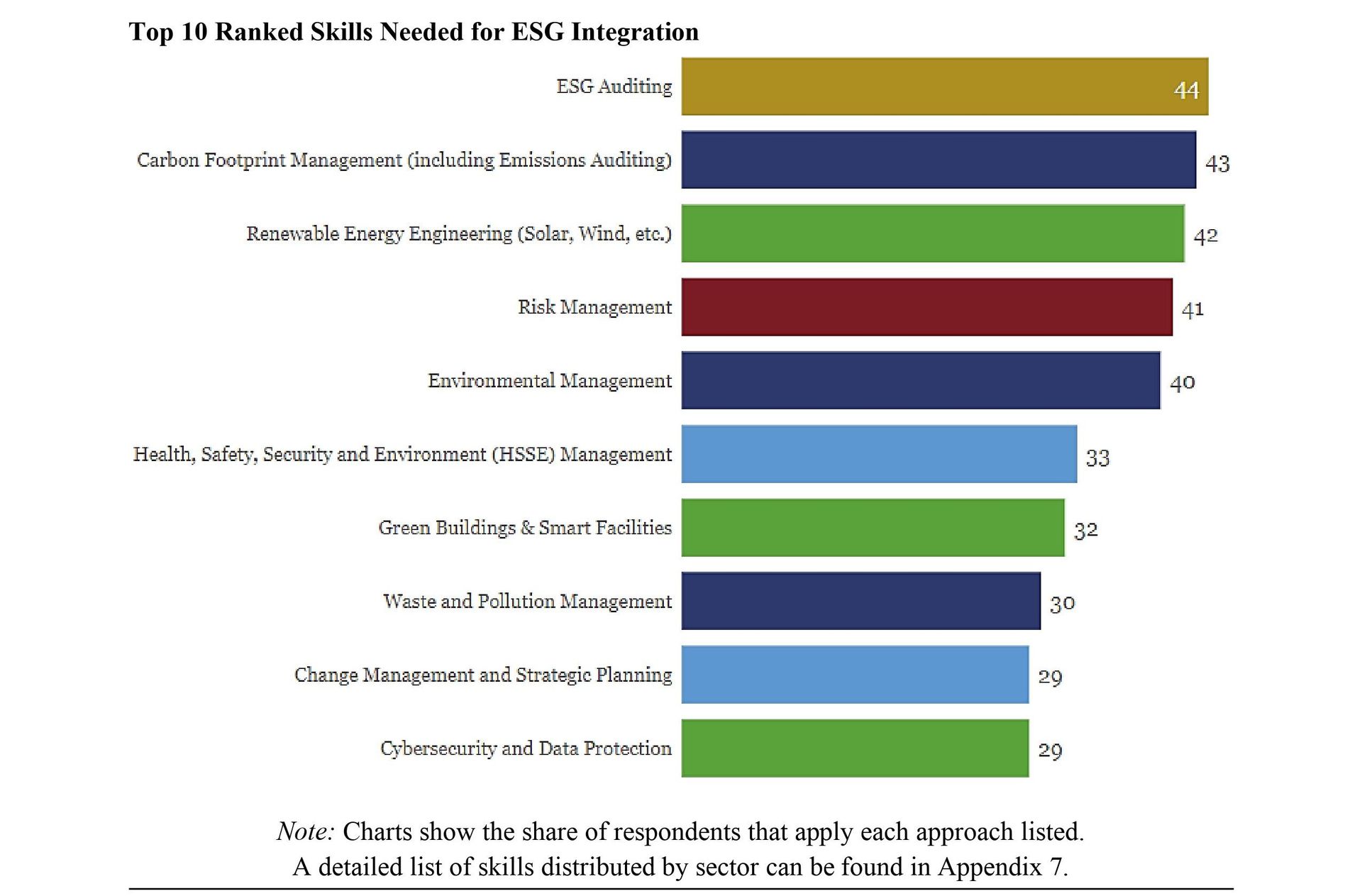

Top 10 Ranked Skills Needed for ESG Integration

The top 10 skills identified across the survey are displayed above, with ESG auditing as the skill in highest demand, followed by carbon footprint management.

11. Main Findings

ESG Landscape of Trinidad and Tobago

There are very few firms that are unfamiliar with ESG strategies and principles in Trinidad and Tobago, with more than 90% having at least a basic level of awareness of ESG. Moreover, more than half of the firms in Trinidad have a high level of awareness. The governance component of ESG is the most important in the TT landscape, followed by social factors. Firms have a greater focus on factors that secure profitability and promote long-term relationships with customers and investors. They are also heavily focused on factors that protect the company against risks and maintain regulatory compliance.

Nonetheless, TT companies are looking forward to being involved in ESG issues such as Climate Action and promoting resilience. There is a moderate expectation that regulation and government involvement will increase within the next 5 years and that regulation will accelerate ESG integration nationally. Firms are willing to engage with regulators toward building mutually beneficial ESG policies. This is particularly important as firms are considering the potential for ESG to increase their cost of production. Nevertheless, ESG is also seen as potentially beneficial in improving the attractiveness of firms to customers, investors, and other partners. ESG is also expected to improve market access across all firms. While these improvements are seen as potential revenue-improving features of ESG, the extent to which ESG investments sufficiently offset the significant costs of adjusting the technical and organisational aspects of their business remains a concern. Nonetheless, TT firms agree that improving ESG regulations will improve their ESG compliance.

More than half of TT firms have active ESG policies either in a single standalone policy or disaggregated documents. However, 36.3% of firms lack active ESG policies. The lack of sufficient incentives and the absence of necessary information for an informed decision prevents firms from adopting ESG strategies. The cost-to-benefit ratio of ESG adoption remains unfavourable for ESG adoption, rendering firms to employ a more precautionary principle. Firms chose to continue to observe the evolving landscape of ESG regulations before engaging in any level of adoption. Moreover, firms lack the technical and managerial skills necessary to fully adopt ESG strategies.

Nevertheless, TT firms employ their own methods of addressing ESG-related issues, which vary across issue contexts. Most environmental issues are tackled by progressively addressing annual targets. Governance and social matters are addressed through formal annual reports, while policies with assigned roles are developed when addressing all three issue types.