How Will You Reframe Your Future?

AMCHAM T&T's/EY Private Sector Economic Outlook Survey 2023

By AMCHAM T&T Staff Writer

LINKAGE Q1 (2023) - Woman's Leadership: Embrace Equity

A

s we transition out of the pandemic, we are witnessing a period of great change and opportunity. Now is the time for organisations to recalibrate and refresh their strategies to ensure long-term success. In other words, how will you reframe your future?

A pulse survey conducted by AMCHAM T&T and EY in November 2022 with c-suite and executive directors/management across eleven industries sought to gain insights into companies' sentiments regarding their:

This encompassed companies’ sentiments around four factors:

1) confidence in the economy to grow,

2) corporate strategy as companies focus on growth and transformation;

3) talent strategy as the risk of migration resurfaces as well as the need for new skills to adapt; and

4) how digitalisation is driving efficiencies and competitive advantage, and other pertinent considerations that continue to impact our local businesses’ operations.

THEME 1 – CREATING CONFIDENCE, GENERATING GROWTH

How are organisations leveraging new opportunities and pivoting to drive confidence and generate growth in 2023?

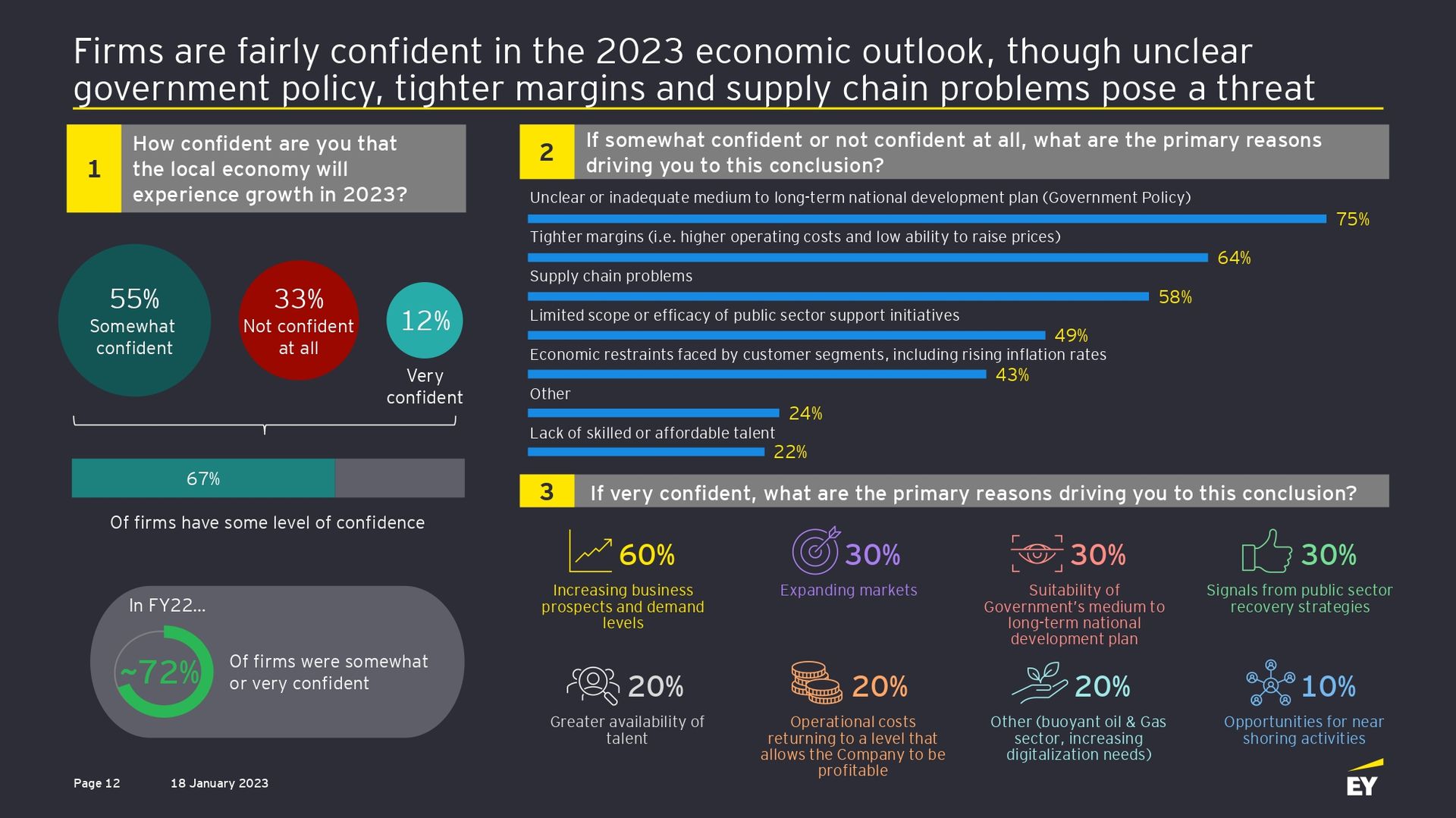

According to the survey, 67% of survey participants expressed confidence in the economy's growth potential in 2023, which is a 5% drop in confidence compared to the previous year.

Respondents cited improving business opportunities (60%), expanding markets (30%), the effectiveness of the government's long-term development plan and signals from public sector recovery strategies as reasons for their positive outlook. Meanwhile, an unclear or insufficient long-term national development plan (75%), tighter profit margins (64%) and supply chain disruptions (58%) were some of the major reasons recognised by respondents for their lack of confidence in the economy’s growth potential.

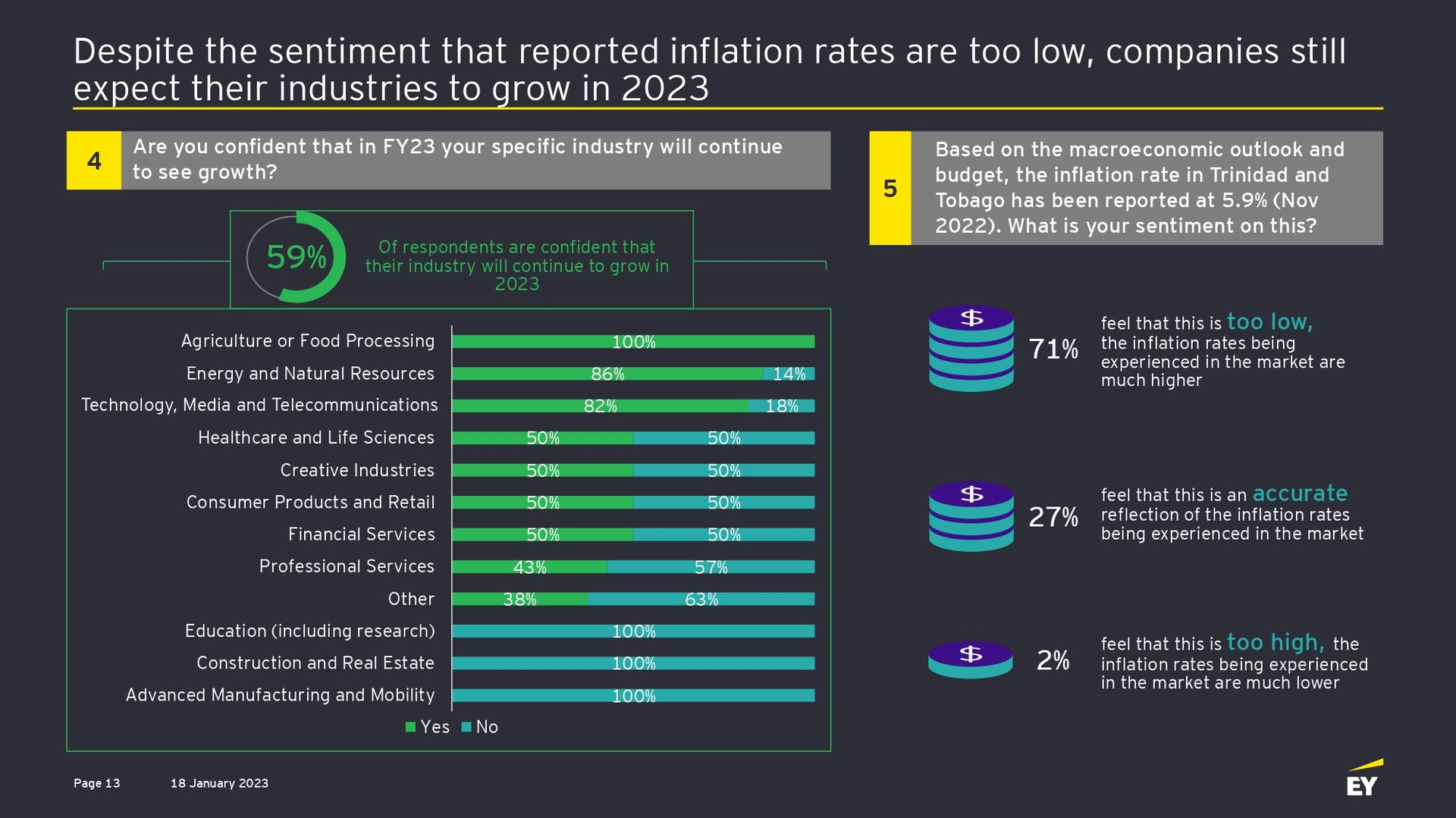

Confidence in the growth potential of the Agriculture and Food Processing industry (100%), Energy and Natural Resources (86%) and Technology, Media and Telecommunications (82%) provided high optimism by business leaders, while the growth prospects of the Education, Construction and Real Estate, and Advanced Manufacturing and Mobility industries showed pessimism.

The top three areas identified by survey participants for government to prioritise in driving economic growth were digital transformation, increasing manufacturing and export potential, and investing in private sector projects with job creation potential. However, when it comes to the private sector's role in driving economic growth, survey participants identified private equity or angel investing, participating in public-private partnerships, and investing in talent development for the future of work as the top contributors.

THEME 2 – TALENT STRATEGY

Over the past three years, the challenges of the evolving business environment have resulted in companies losing skilled employees and having to recruit at high costs and with reduced productivity. So, how are companies adjusting their workforce to effectively tackle these challenges?

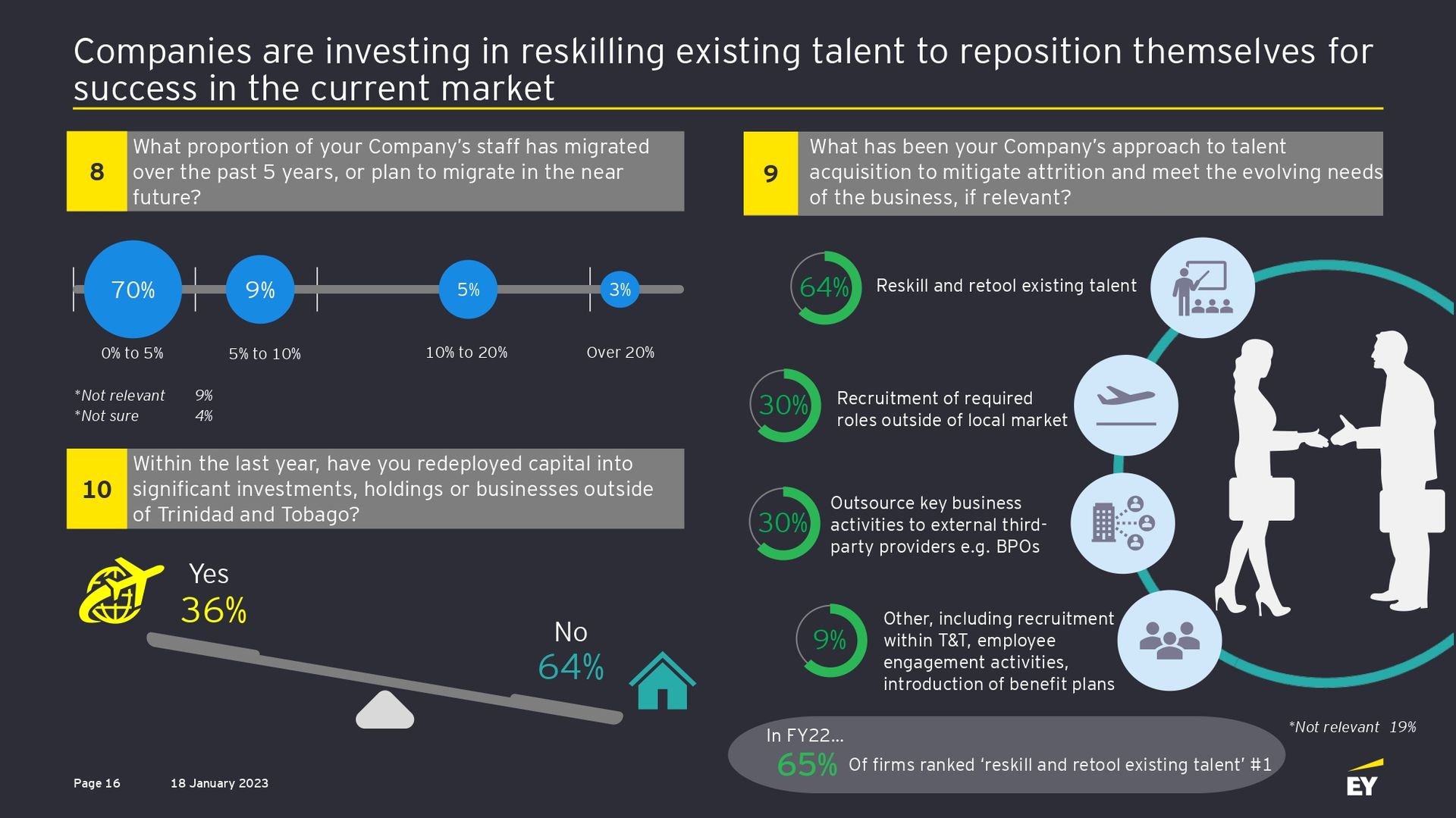

The survey showed that the majority or 70% of companies experienced between up to 5% attrition through migration, while 3% of survey participants reported over 20% migration.

Companies that are not looking to increase their headcount said they have begun shifting from hiring new talent to upskilling their current workforce. 64% of survey respondents reported that their organisations are investing in retraining and upskilling their existing workforce to adapt to changing needs.

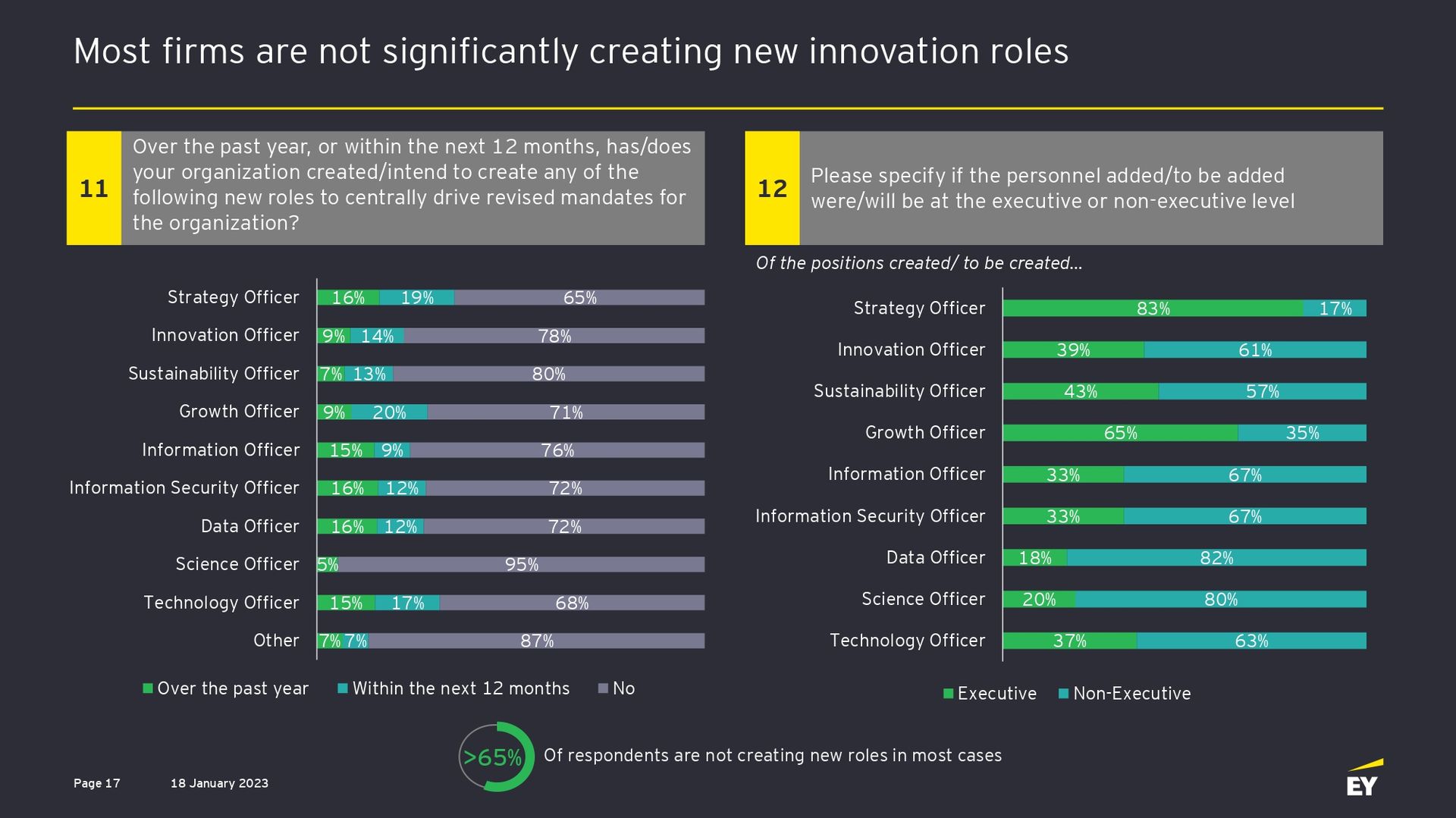

Also, companies have expressed slightly more willingness around creating roles to drive innovation and strategy in 2023 with the creation of a Strategy Officer, Technology Officer, and Sustainability Officer among the top 3 roles created.

THEME 3 – CORPORATE STRATEGY

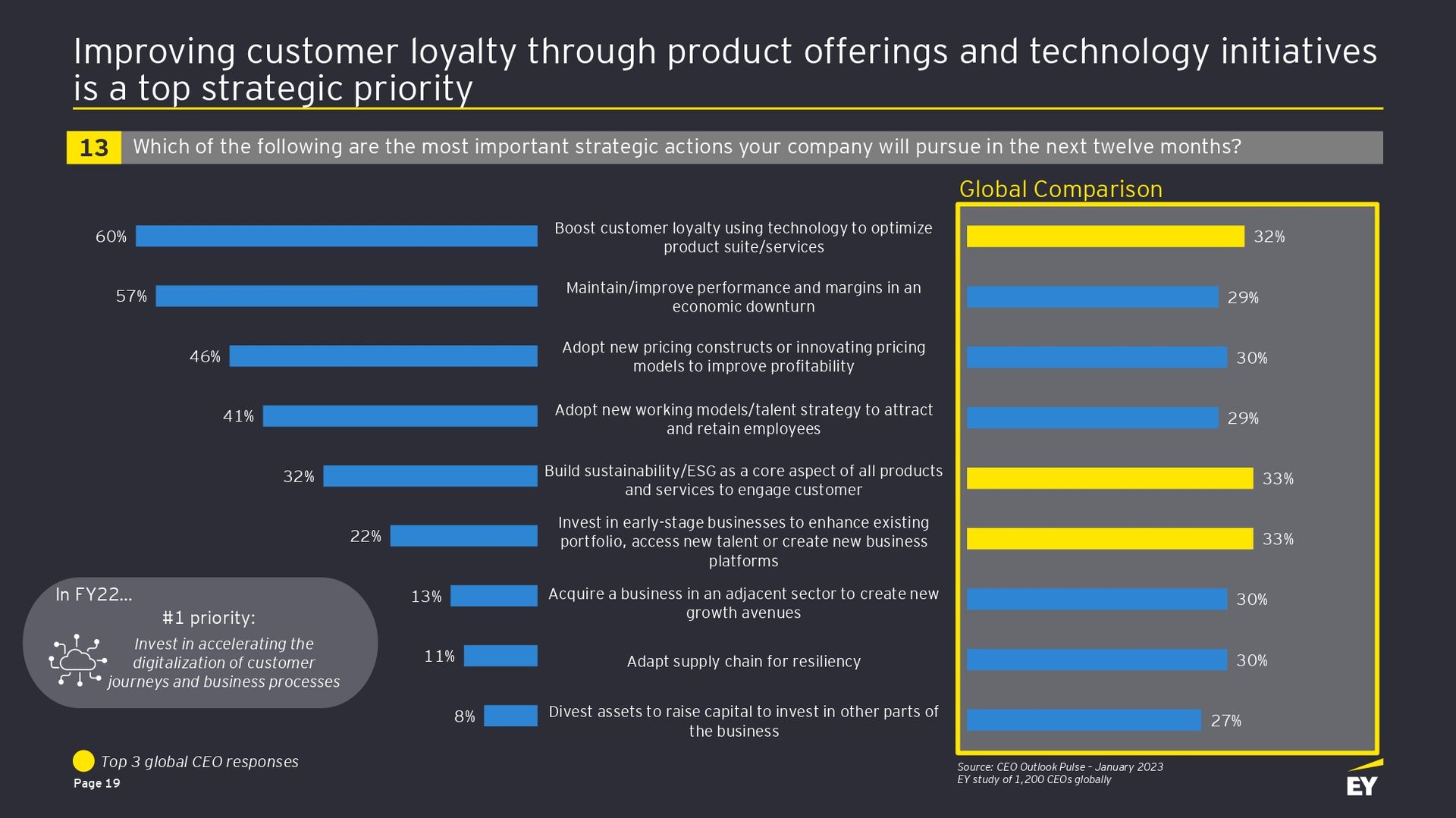

While investing in accelerating the digitalisation of customer journeys and business processes was the top strategic priority for companies in 2022, the focus in 2023 was shifting in favour of the following:

1. Boosting customer loyalty using technology to optimise product suite.

2. Maintaining/improving performance and margins in an economic downturn.

3. Adopting new pricing constructs or innovating pricing models to improve profitability.

Globally, boosting customer loyalty was the #3 priority, while the top focus was on building sustainability and ESG, which ranked #5 in T&T. Innovation through Investing in early-stage businesses to enhance existing portfolios, access new talent, or create new business platforms ranked #2 globally, which local survey participants ranked at #6.

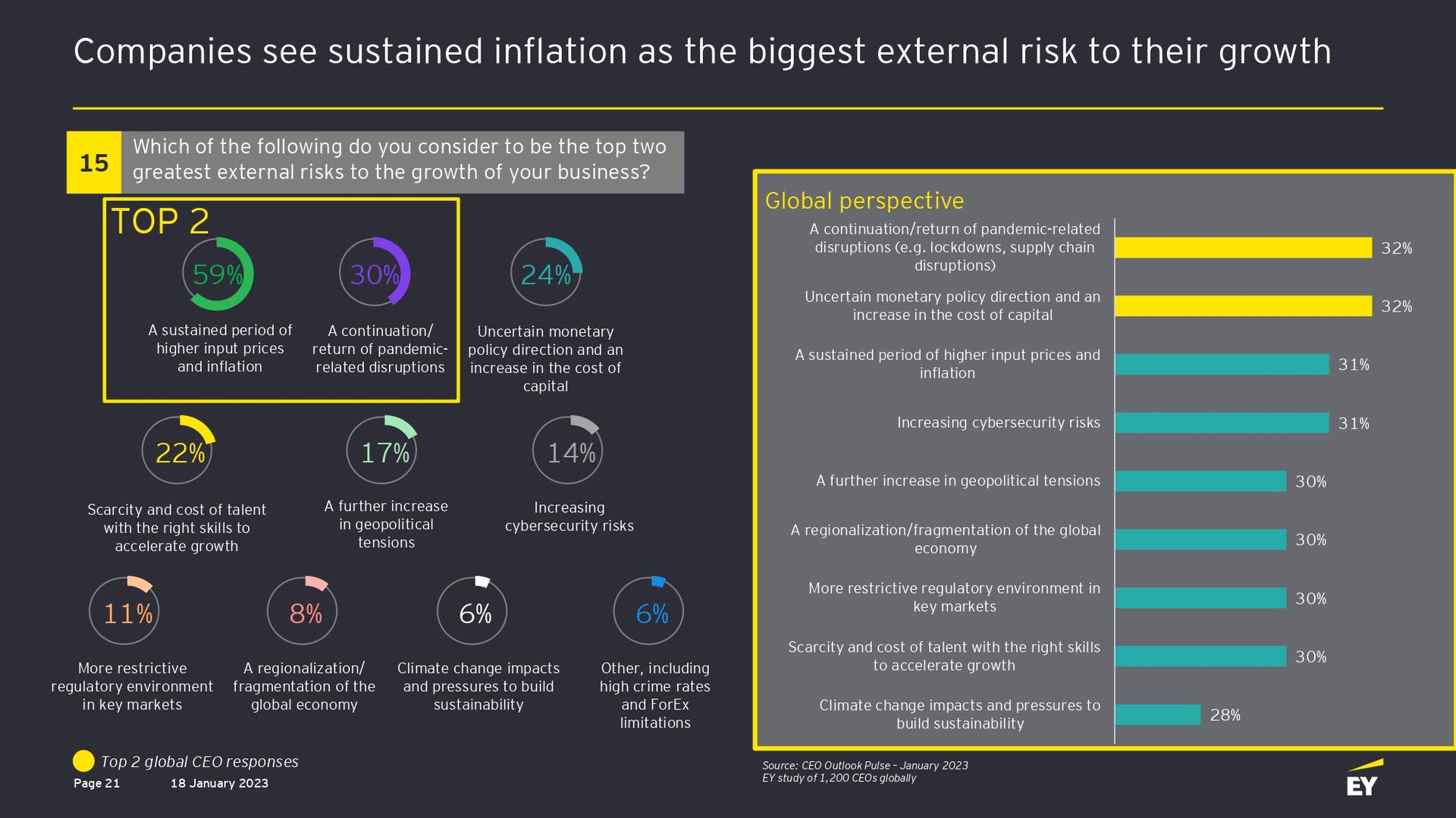

It came as no surprise that 59% of survey respondents ranked sustained periods of higher input prices or inflation as the greatest external risk to growth, given the rising inflation rates. Globally, this issue is also ranked as one of the top external risks, with companies seeing major or extreme input price increases across all measures, from labour to raw materials.

A continuation or return of pandemic-related disruptions was ranked second on the list of challenges (30%), which is consistent with global results, indicating that these vulnerabilities are not isolated to the local market.

THEME 4 – DIGITALISATION

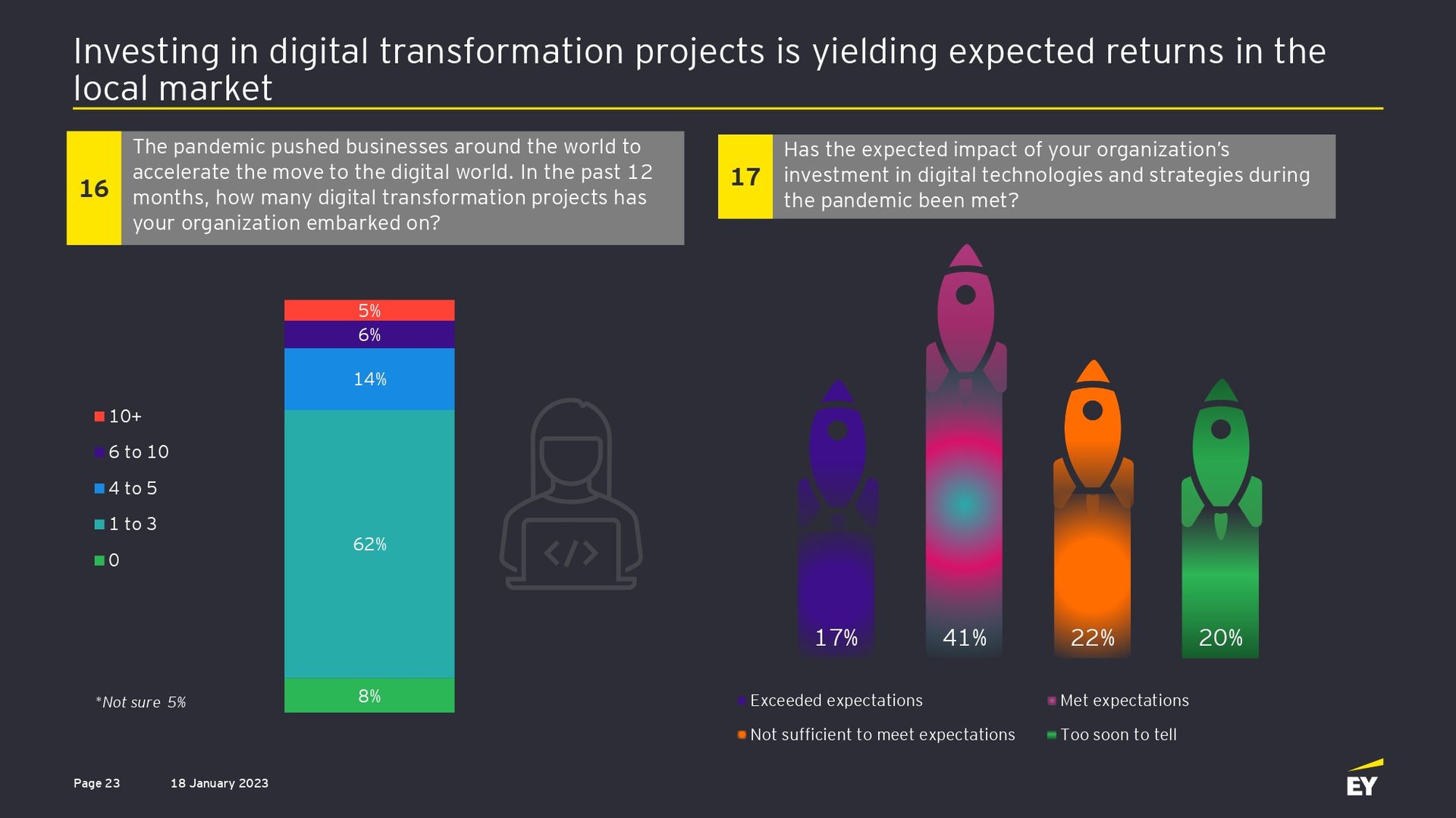

The survey found that both global and local companies are making record-breaking investments in digital transformation, with 87% of survey respondents indicating that they embarked on digital transformation projects over the last year. The results also showed that most companies embarked on 1 to 3 projects, while 14% undertook 4 to 5 projects, and 5% of respondents undertook major transformation, with over 10 projects started in the last year.

Of those who invested in digital transformation, 41% found that their returns met expectations and 17% found they exceeded them. This is in line with global results, as 41% of global companies measured positive returns on their digital investments.

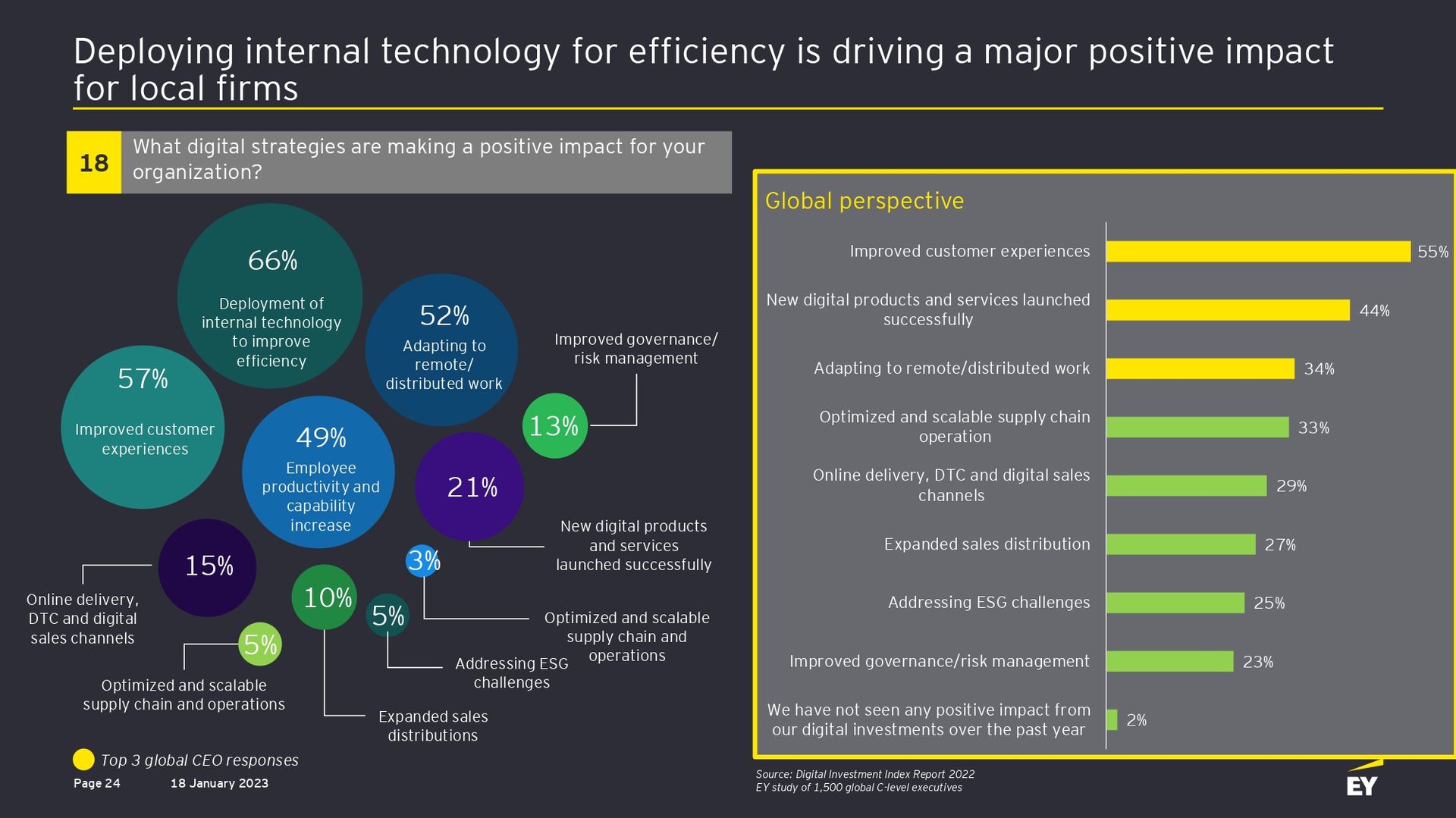

The top 3 digital strategies making a positive impact locally were:

1. Deployment of internal technology to improve efficiency;

2. Improved customer experiences; and

3. Adapting to remote work.

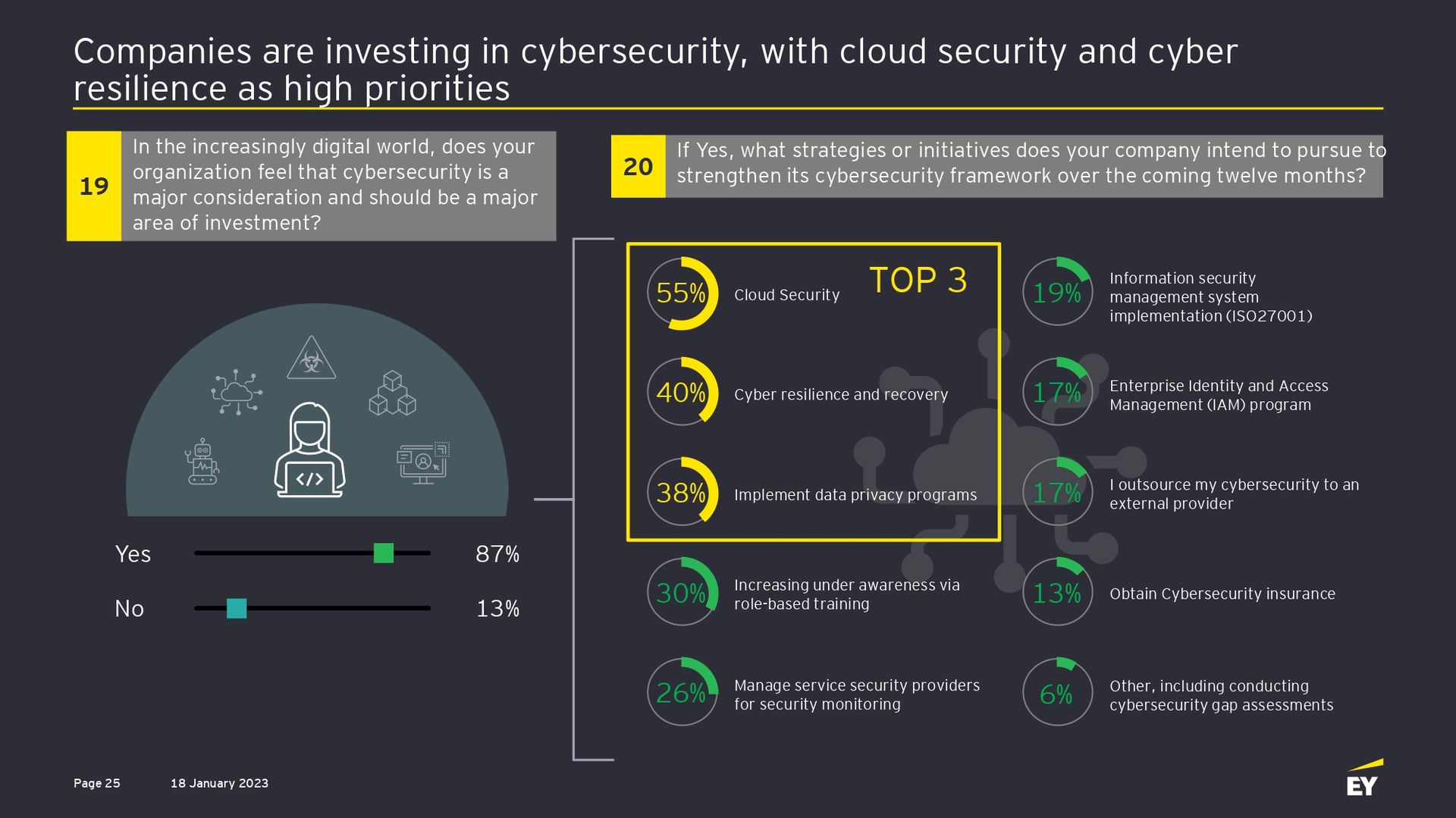

Cybersecurity has emerged as an important part of doing business, since companies are relying more heavily on digital technologies to operate and connect with customers. The survey found that 87% of participants feel that cybersecurity is a major consideration and should be a major area of investment.

This has been brought on by the shift to remote work, increased use of digital platforms, and the sharing and storing of more data and sensitive information which have created new vulnerabilities for cyber-attacks and data breaches.

THEME 5 – OTHER CONSIDERATIONS, INCLUDING ESG, FOREIGN EXCHANGE, SUPPLY CHAIN

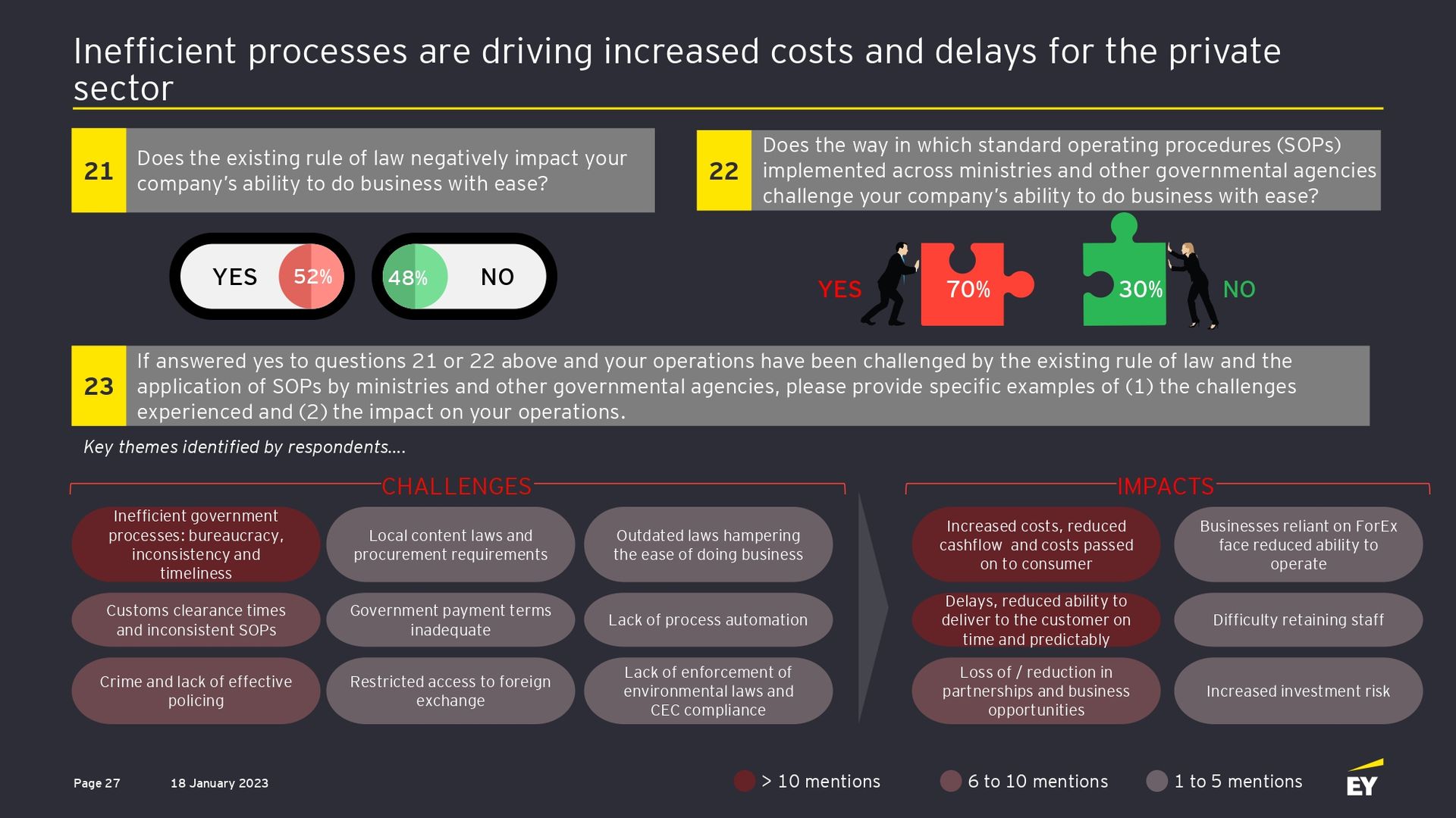

The biggest challenges affecting companies’ ability to reframe their strategy was inefficient government processes, in particular a difficult and tedious bureaucracy, inconsistent application of SoPs, and lengthy wait times. Respondents also identified challenges associated with the operations of the Customs Division, crime and the lack of effective policing as other major challenges.

These challenges resulted in significantly increased costs and delays, which negatively impact business operations and cash flow. The impact of these challenges trickles down to the consumer, as companies are unable to absorb costs or deliver to the customer on time. Loss of or reduction in partnerships and business opportunities were also reported.

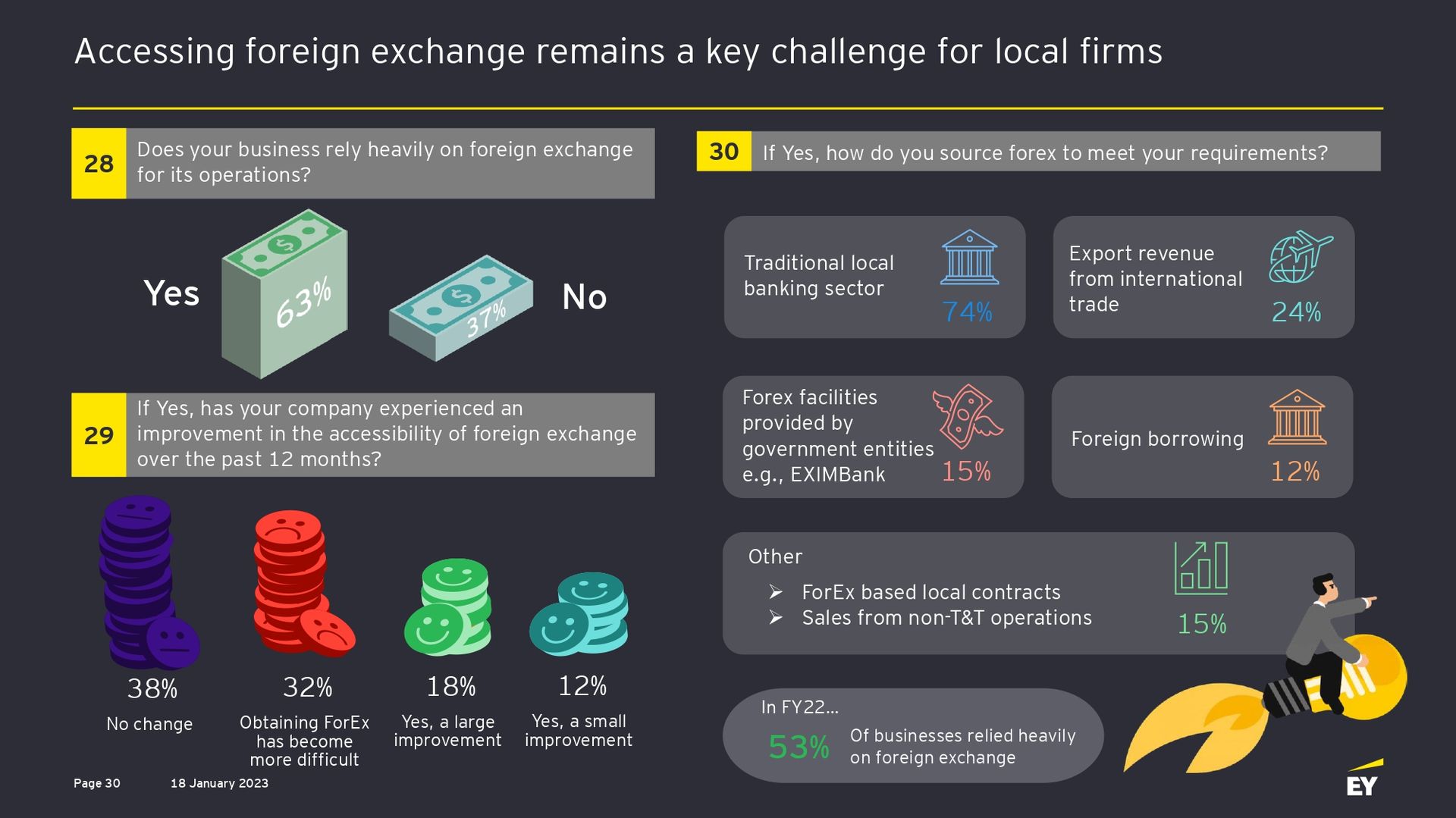

Access to foreign exchange is another key challenge for local firms, with 38% of companies finding that there has been no change in accessibility, while 32% found that it actually became more difficult.

While embedding ESG in corporate strategies has been a major focus for global firms and has been considered a driver of growth, locally ESG does not appear to be as high on the strategic agenda for surveyed organisations. The survey found that the majority of survey participants did not implement any ESG strategies in the last year, with 31% intending to do so in the coming year.

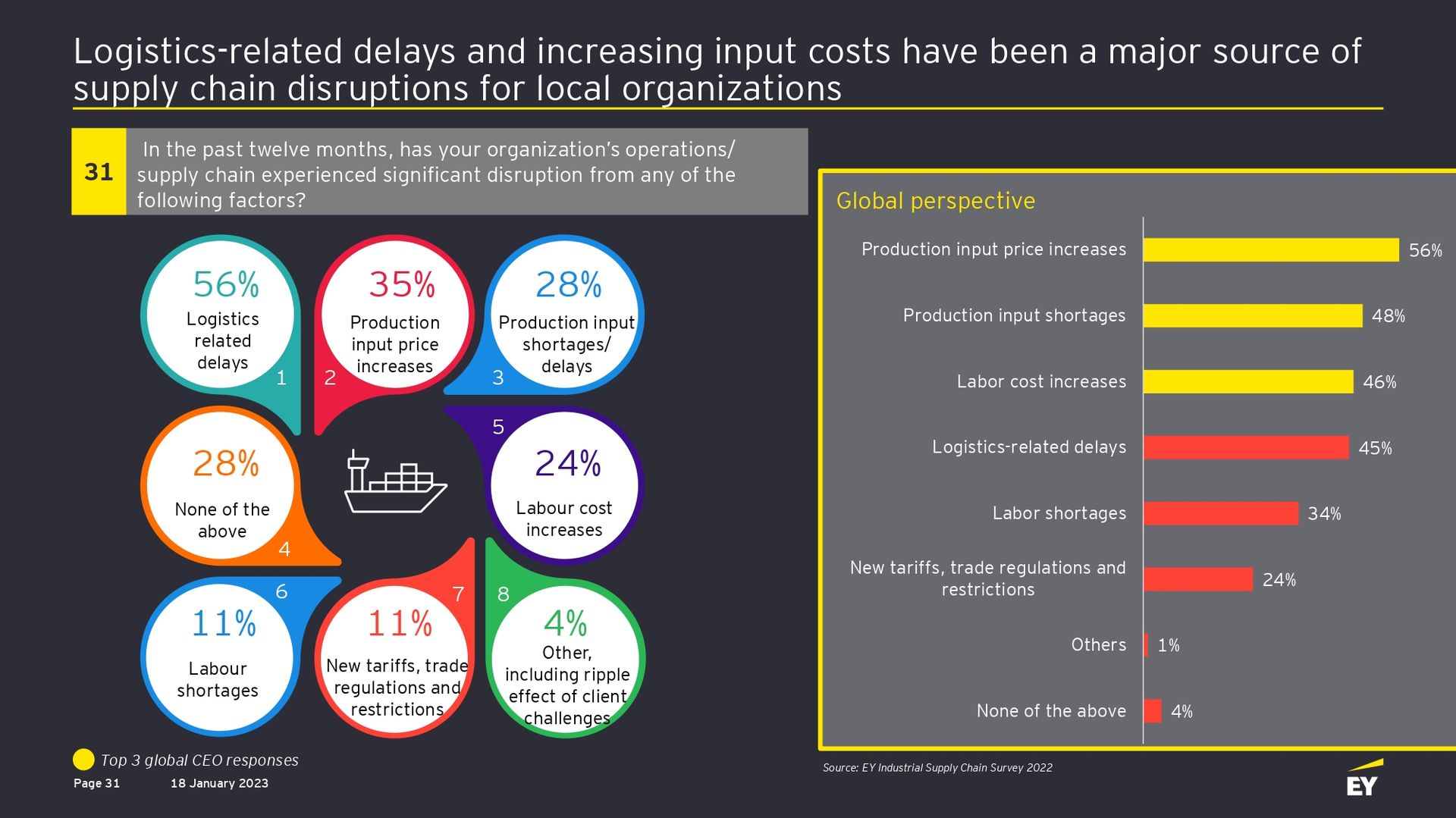

Also, challenges arising out of supply chain disruptions have caused local firms to reconfigure their supply chains as a mitigation strategy. Companies are also looking to source local alternatives for inputs, and some have also delayed planned investments. This mirrors what is happening on a global scale. Delaying planned investments and reconfiguration of supply chains are the top 2 mitigation actions, closely followed by the relocation of operational assets.

CONCLUSION

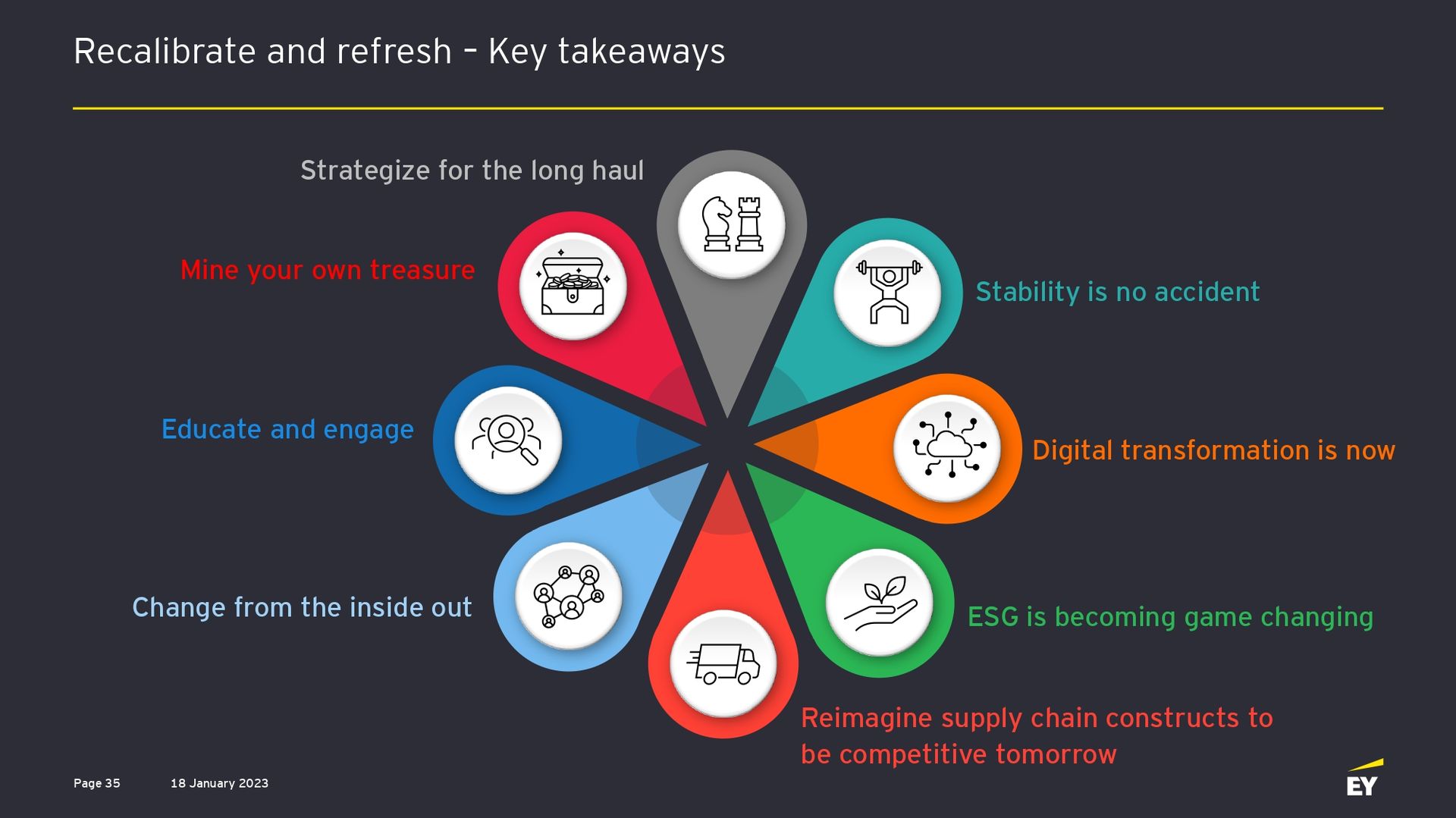

The pandemic has been a wake-up call for many companies, and the transformation is imperative. The survey findings provided the following key takeaways:

• Strategise for the long haul: Focus on efficiency and stronger stakeholder engagement – emphasising long-term value over short-term wins.

• Mine your own treasure: Use customer data to help predict changing behaviours and define future strategies.

• Educate and engage: Refresh your narratives to engage investors and all internal and external stakeholders – articulate a positive vision and respond to concerns quickly.

• Change from the inside out: Reconfigure internal processes to strengthen operational resilience and the talent agenda, while engaging external ecosystems to position for future growth.

• Stability is no accident: Strategically prioritise for the next unforeseen shock to help ensure optionality across the enterprise, including supply chain security and channels to customers.

• Digital transformation is now: Establish clear rules to drive capital allocation strategies, while simultaneously considering corporate strategy goals, the company’s tech portfolio, return on investment, and potential impact on the business.

• ESG is becoming game-changing: Place focus on integrating ESG principles into your businesses’ operations. As consumers and investors become more conscious of the impact of business on society and the environment, companies are under pressure to integrate ESG principles into their operations.

• Reimagine supply chain constructs to be competitive tomorrow: A large number of global companies are already rethinking their supply chain setup. Companies must act quickly and decisively if they want to have resilient supply chains and remain competitive.